Ever found yourself swiping your card as a quick fix for a mood? How to track emotional spending — it’s that impulse to shop when joy, sadness, or stress hit hard? Ever found yourself shopping online when you are bored? Money and mood weave together, often twisting logic with a powerful rush of feeling.

How much further along would you be with your financial goals without compulsive spending when you are bored, sad or stressed out? Ever wonder if your picture is in the dictionary by the term shopaholic?

That’s where the emotional spending journal steps into the spotlight. It’s a sleek, no-nonsense tool, reflecting every purchase through the lens of feelings before, during, and after buying. Tracking these moments goes beyond budgeting—it’s style-meets-self-awareness for your wallet. This self-check is about building honesty and putting your emotional triggers in the front row, not buried backstage.

Pausing to write down your thoughts isn’t just about better spending. It’s about real personal growth, cultivating clarity, and carving your signature approach to financial wellness. Start tracking. You’ll shop with intention (and maybe even a little swagger).

Check out this deep dive for more on how emotions affect your spending: What Emotional Spending Does to your Brain.

Low Income Savings Challenge Book

What Is Emotional Spending?

Let’s call it the “retail therapy trap”—those moments when a quick tap of “add to cart” or a stroll through busy aisles feels like a mood makeover. Emotional spending is when you shop based on feelings, not actual needs. Ever found yourself shopping online when you are bored? This could look like snagging new sneakers to squash boredom, grabbing takeout when stress is peaking, or splurging on a fresh fragrance just because you nailed a presentation. The truth: feelings steer those purchases, not logic.

Why do we do this? The answer sits smack in the middle of psychology and neuroscience. Shopping lights up the brain’s reward system. When you buy, your brain releases a rush of dopamine, which acts like confetti for your mood—temporarily making you feel better. But that rush doesn’t last. The aftermath is often a heady mix of regret and confusion—where did my money go?

Curious about the science behind all this? Psychology Today breaks down how emotions often hijack your spending habits—sometimes in ways that aren’t even on your radar. For more, check out The Psychology of Emotional Spending.

Shopping driven by emotion isn’t just about “feeling down.” Sometimes it’s the high you chase—like the perfect pair of jeans that screams treat yourself right after a long week. Emotional spending is about instant mood repair, and the cycle often repeats.

Common Emotional Spending Triggers

Behind every impromptu shopping spree sits an emotion, sometimes bold, sometimes lurking under the surface. Here are the most common emotional triggers that send people straight to checkout:

- Stress

Your inbox is bursting. Deadlines are looming. Suddenly, there’s an urge to order fancy takeout or online shop just to feel a sense of control. Example: After a tense workday, Joe justifies a sushi splurge—“I deserve it after today”—yet the guilt soon creeps in. - Boredom

Idle hands, open tabs. When life feels dull, filling the cart can bring a flash of excitement. Example: During a rainy weekend, Mia scrolls through fashion apps, buying things she’ll barely wear, just to shake up her routine. - Loneliness

Empty apartment, silent phone. Shopping fills the gap, offering quick comfort or a vibe of connection. Example: After moving to a new city, Raj racks up delivery bills and quick-fix online purchases—loneliness disguised as “self-care.” - Celebration

Success feels sweet—and that feeling sometimes whispers, “go bigger.” Shopping becomes the reward. Example: Jenna lands a promotion. She heads straight to her favorite boutique for a designer bag—her win, her treat.

Every trigger has its own flavor, but they all feed a pattern: emotion, impulse, purchase, and then the inevitable come-down. According to insights from Focus on the Family, the root of the urge is rarely about the stuff—it’s about the feeling you’re chasing or avoiding.

Emotional spending isn’t random. You’ll spot patterns if you pay enough attention, and that’s the goal behind keeping an emotional spending journal. Time to notice the triggers, name them, and decide if a purchase fits your real wants or just today’s moods.

For a deep dive on what emotions trigger impulsive spending most, browse through Emotional spending: what is it and how to manage it?.

Emotional Spending Control Guide Planning Notebook:

The Benefits of Keeping an Emotional Spending Journal

A well-kept emotional spending journal takes your financial self-care up a notch. It’s more than a record of receipts; it’s a mood ring for your wallet. When you document not just what you buy, but how you feel, you’re tuning in to patterns that shape both your headspace and spending style. From boosting emotional intelligence to reshaping your money habits, the journal is a powerful accessory for anyone looking to move beyond blind splurges to mindful spending.

Photo by Greta Hoffman

Emotional and Psychological Benefits

Journaling your spending triggers isn’t just self-reflection—it’s mood therapy on paper. Breaking the cycle of automatic shopping starts by naming the feeling and tracing it back to the trigger.

- Processes Emotions On Your Terms

Writing slows you down when the urge to buy hits. Instead of reruns of guilt and regret, you have a moment to ask: What’s behind this craving? Are you bored, lonely, or celebrating something?

The process helps air out emotions that would otherwise stew beneath a pile of packages—transforming purchase regret into real clarity. - Reduces Anxiety and Rumination

When you jot down your feelings before, during, and after a purchase, you diffuse pent-up stress. This tiny ritual gives you more control, cutting down on the anxiety that comes from unchecked money moves. A study cited by the University of Rochester Medical Center spotlights how journaling supports emotional wellness and can ease anxiety and stress (Journaling for Emotional Wellness). - Fosters Mindfulness and Self-Compassion

Mindful spending stems from mindful pausing. That log of thoughts and feelings is your backstage pass to self-awareness. You notice urges as they happen—not after the fifth online order of the week. It also gives you a break from harsh self-judgment; instead of criticism, you map out a plan.

Many mental health professionals recommend journaling as a path to greater self-compassion and emotional strength (5 Benefits of Journaling for Mental Health).

52-Week Mental Health Journal:

Financial and Behavioral Benefits

An emotional spending journal isn’t just emotional spring cleaning—it’s a trend report for your habits. You start tracking the “why” behind every impulse, turning scattered data into a story you can actually rewrite.

- Spot Patterns Hiding in Plain Sight

Instead of wondering where your paycheck vanished every month, you get receipts with context. By pairing each buy with a mood, you surface trends—like late-night scrolling after stressful days or shopping when you’re craving connection. - Breaks Unhealthy Money Cycles

The journal catches red flags before they go full-blown. You start predicting emotional splurges and rerouting energy into healthier outlets, like texting a friend or taking a walk instead of loading up your cart. This is how you break the old script and build habits that stick (Emotional spending: what is it and how to manage it?). - Promotes Intentional, Conscious Spending

When you see your emotions lined up next to your expenses, casual shopping morphs into intentional investing—in yourself, your joy, and your long-term goals. By tracking not just the price tag but the mood, you create a feedback loop that makes every dollar count.

Experts agree that mindful spending brings laser focus to your budgeting skills and helps sidestep regrets (The Psychology of Spending: Mindful Money Habits). - Builds a Personalized Blueprint

Think of your journal entries as fabric swatches in the mood board of your financial life. Add up enough entries and you’ll stitch together a style of money management that’s authentic to you.

Curious to see how a little self-reflection can make your financial style feel as fresh as a new season? It all starts with the journal.

Spent: Break the Buying Obsession

How to Start and Maintain an Emotional Spending Journal

Keeping an emotional spending journal is like having a backstage pass to your own financial emotions. When you start tracking your feelings alongside your purchases, you gain a clear snapshot of patterns that often fly under the radar. Think of it as a personalized style diary—but for your spending moods and money moves. This self-awareness makes your financial choices with intention, not impulse.

If you’re new to journaling your emotional spending or want to deepen your practice, here’s a guide to what to track and how to keep your journal engaging, honest, and effective. Whether you prefer jotting notes in a chic notebook or tapping away in a digital app, this guide will help set you up for success.

Essential Elements to Track

An emotional spending journal doesn’t have to be a chore. Stick to a simple, clear format that records the core details you need to spot your emotional spending patterns quickly. Here’s what to write down with practical examples for each:

- Emotional State: What mood are you in before buying? Tired, anxious, excited, lonely?

Example: Feeling stressed after a long day at work. - Trigger: What specific feeling or event nudged you to spend?

Example: Getting an upsetting email from a client. - Item Purchased: What did you buy? Detail it briefly.

Example: Ordered comfort food delivery. - Situation: Where and when did the spending happen?

Example: At home, around 8 p.m. after work. - Cost: How much did you spend? Be precise.

Example: $25 for a large pizza and soda. - Aftermath: How did you feel after the purchase? Relief, guilt, satisfaction?

Example: Relief turning into regret within an hour.

Logging these points creates a vivid map of your spending habits. Over time, you’ll see trends, like the late-night temptation to shop online when boredom strikes or reaching for small splurges to reward yourself during stressful weeks.

The Emotion Behind Money Workbook

Common journal names or formats include money and emotion tracker, daily money mood tracker, or simply a spending patterns log. These give your entries structure and make your emotional spending journal a reliable reflection tool.

For a smoother start, apps like Day One or even a simple self-awareness financial journal in a lined notebook can do wonders. Just make sure it’s private and easy for you to access daily. The key is consistency—take a moment right after spending or at the end of your day to jot down your notes.

Photo by Engin Akyurt

Prompts and Techniques for Effective Journaling

To keep your journal fresh and insightful, use prompts and creative strategies that pull you beyond just listing facts. These techniques add layers of self-reflection and keep you engaged with your emotional spending story.

Journaling Prompts:

- What feeling was strongest before I spent money today?

- How would I soothe this feeling without spending?

- Which past purchases brought genuine happiness, and which didn’t?

- What was I avoiding by spending?

- How does my mood right now compare to my mood before the spend?

These prompts align with practices often used in emotional spending journals or mindful spending journal examples. Prompts from sources like How to manage emotional spending according to a recovering emotional spender offer insightful angles on noticing patterns and exploring alternatives.

Techniques to Try:

- Mood Tracking: Use simple mood icons or color codes to mark your emotions. This helps visualize shifts you might miss in words alone.

- Visualization: Picture yourself handling urges with an empowering alternative—like calling a friend instead of clicking “buy.”

- Mindful Reflection: Slow down your writing to include your body’s sensations and reactions linked to spending. Are your shoulders tense? Breathing shallow? Write it down.

Combining these methods with your journal entries turns your notes into a personalized financial self-reflection journal or even a personal finance empathy journal—where you treat your spending habits with kindness, not judgment.

Other helpful prompts and questions to keep handy:

- Reflection questions for spending habits

- Daily prompts for money mindfulness

- Guided journal pages focused on emotional purchases

- Self-discovery questions about money and overspending

- Awareness prompts for when spending feels automatic

Many find that this deeper approach helps break the cycle of impulsive buys and replaces it with thoughtful choices. You’ll start spotting exactly which emotions act like the loudest salespeople in your mind.

Journaling about money can become a reliable ritual—a moment of pause to pause, reflect, and rethink. This practice not only sharpens your spending instinct but cultivates a subtle confidence in your financial life.

For more ideas on journaling prompts and effective emotional tracking, check out Journaling About Money-Related Stress Can Boost Your Health and Finances.

A Mindfulness-Based Stress Reduction Workbook

Now you have the essential tools to log your emotional spending clearly and creatively. Keeping this practice up will add a sense of control and clarity, helping your money habits align better with your real moods and goals.

Analyzing Your Journal to Identify Patterns and Triggers

Keeping an emotional spending journal is just the start. The real magic happens when you go back, read through your entries, and decode the patterns beneath the surface. Your journal turns from a simple record into a powerful lens revealing the emotional triggers that repeatedly push you to spend. Analyzing these notes lets you spot not only what you buy but why, helping you build strategies that fit your unique rhythm and tendencies.

This section will guide you through reviewing your journal with a keen eye and turning those insights into clear, actionable steps. You’ll learn how to transform self-awareness into real change, creating smarter habits and breaking emotional spending cycles with intention.

Turning Insights into Action

Once you’ve collected a few weeks or months of journal entries, it’s time to review them strategically. Approach your journal like a personalized map revealing where spending detours happen. Here’s how to turn reflections into concrete actions:

- Identify Recurring Triggers

Look for emotional patterns that repeat across entries. Is stress your biggest impulse driver? Maybe loneliness, boredom, or celebration? Pinpoint your top triggers. A helpful resource is this list of common emotional spending triggers which can help you compare your experiences. - Spot Spending Habits and Moments

Notice the times and contexts where spending spikes — late nights, weekends, or after difficult calls. Recognizing these helps you prepare ahead for vulnerable moments. - Set Clear Spending Rules

Based on your findings, create personal guidelines tailored for your triggers. For example:- No online shopping after 8 p.m.

- Limit celebratory splurges to one item per month

- Use a waiting period (24-48 hours) before any non-essential purchase

These rules sharpen your spending decisions and put a pause on impulsive buys.

- Try Alternative Coping Mechanisms

Emotional spending often masks a need to soothe feelings. Replace shopping with healthier outlets informed by your triggers:- For stress, try a 5-minute breathing exercise or a quick walk

- When lonely, call or message a close friend instead of browsing stores

- Bored? Dive into a creative hobby or watch a favorite show

These swaps build resilience and gradually retrain your brain to seek comfort beyond retail therapy.

- Celebrate Your Progress

Positive reinforcement is key to habit change. Track your wins, no matter how small — a week without emotional purchases, or spotting a trigger early. Celebrate those moments with non-financial rewards, like a favorite podcast episode or a self-care night. For inspiration, see ideas on building habits to stop overspending. - Use Habit Trackers or Accountability Journals

Tools like a habit tracker for overspending or an emotional spending accountability journal keep you honest and motivated. These provide structure and gentle reminders to check in with yourself daily or weekly. You can explore some great options in this financial habits tracker roundup. - Schedule Regular Reviews

Set aside time monthly or biweekly to scan your journal and evaluate your spending journey. Consistent evaluation keeps you tuned in, helps adjust your strategies, and confirms how far you’ve come. This monthly rhythm is crucial for lasting change.

Taking these steps turns your emotional spending journal into a roadmap for progress, not just reflection. You flip the script from reactive buying to proactive living, aligning your money habits with your emotional well-being.

Photo by cottonbro studio

For deeper insight on emotional spending patterns and how to reframe them, this article on the psychology of emotional spending offers a thorough yet accessible look at how feelings drive purchases and what to do about it.

In practice, your journal and these actionable steps become a personal style guide for spending — a way to understand your unique fashion of coping, celebrating, and living through money choices. Keep tuning in, and you’ll master the art of spending with clarity and control.

Integrating Your Emotional Spending Journal into Broader Wellness Goals

The Money Journal: Understanding Your Spending Habits in 36 Months

Your emotional spending journal is more than just a record of money spent and feelings felt. It’s a vital bridge connecting your financial habits with your overall wellness. When you start to see the threads linking emotional spending to your stress levels, self-care routines, and even mental health, it opens up powerful opportunities. Integrating this journal with tools like budgeting, mindfulness, and mental health practices helps turn isolated insights into lasting change.

Connecting a spending journal with broader wellness goals encourages you to treat money habits as part of your emotional and physical well-being. It’s about nurturing balance—where your wallet reflects and supports your best self, not just your impulses on a tough day.

When to Seek Professional Support

Recognizing when emotional spending points to something deeper is key. If your journal entries reveal patterns that feel overwhelming or unmanageable, it might be time to bring in expert help. Here are some signs and suggestions to consider:

- Persistent Spending That Feels Out of Control

Regularly logging purchases driven by strong emotions—whether it’s stress, loneliness, or boredom—that lead to financial trouble might be a signal. If your emotional spending causes repeated debt or conflicts, professional guidance can help you regain footing. - Emotional Spending Tied Directly to Mental Health Struggles

Sometimes overspending masks anxiety, depression, or trauma. If your journal reveals you’re using shopping as a primary way to cope with intense feelings or mental health symptoms, consider a therapist who specializes in emotional regulation and behavior change. - Difficulty Breaking Patterns Despite Awareness

You might spot triggers and trends clearly in your journal but still feel stuck in the spending cycle. This gap between insight and action is a red flag that a financial counselor or behavioral specialist could help you close. - Financial Stress Affecting Relationships or Quality of Life

When emotional spending creates tension with family, friends, or disrupts your daily function, support groups or counseling can provide community, tools, and accountability. - Feeling Overwhelmed by Confusing or Conflicting Emotions About Money

Talking through your feelings with a professional can clarify emotional blocks, provide new coping mechanisms, and support healthier spending behaviors.

Professional resources include therapists with expertise in emotional spending or compulsive behaviors, certified financial counselors focused on money psychology, and peer support groups centered on financial recovery.

Working with experts complements your journal by adding strategies tailored to your story—transforming emotional awareness into practical, sustainable wellness. You don’t have to tackle emotional spending alone; combining your journal with the right help turns a challenge into a growth opportunity.

Photo by Pavel Danilyuk

Expanding your emotional spending journal into a mindful spending habits journal can deepen self-awareness and bring your money choices in line with bigger life goals. For inspiration and tools on combining journaling with mindfulness techniques, see resources like The Mindful Spending Journal on Amazon or The Mindful Money Journal. These guides help embed your new insights into daily routines and budgeting practices that honor your emotional needs and financial health.

If impulse buys are your hurdle, strategies and journaling prompts found in The Simple Tactic That’s Kept Me From Impulse-Spending offer practical ways to catch urges before they take over. For integrating mindfulness into your money routine, check out Mindful Spending: 10 Ways to Save Money and Lower Stress, which offers exercises that complement your journal’s findings perfectly.

Together, journaling, mindful reflection, and professional support form a powerful trio. This combination allows you not just to track your emotional spending, but to rewrite your money story with self-compassion, intention, and clarity.

Templates & Printables

If you’re serious about taming emotional spending, ready-made templates and printables can be your best allies. These tools make journaling feel less like a chore and more like a tailored, clear path toward understanding your money moods. Why start from scratch when you can use proven formats to quickly capture your emotions, triggers, and spending patterns? Their structured design helps you stay consistent and focused, turning abstract feelings into actionable insights without the overwhelm.

Using these resources also invites a bit of fun and style into financial self-care—much like slipping into your favorite outfit that fits just right. Whether you prefer digital trackers or printable sheets, there’s a perfect match ready to boost your emotional spending journal routine.

Emotional Spending Journal Templates

Templates give your emotional spending journal a sleek framework so you capture exactly what matters without fluff. They guide you through noting feelings, reasons for purchases, and aftereffects—all in one place.

Here are some top picks to get you going:

- Emotional Spending Tracker Template on Notion

- Money Values – Emotional Spending Worksheet on Etsy

- Emotional Spending Worksheet with Progress Tracker on Etsy

These give a clear, simple way to track moods side-by-side with spending, helping you see exactly how your emotions steer your purchases.

Printable Emotional Spending Trackers

If your style skews toward pen-and-paper or bullet journaling, printable trackers bring a tactile edge. They slip right into your planner or sit on your desk, letting you quickly jot feelings and expenses anywhere.

Try these downloadable printables designed for emotional spending awareness:

- Emotional Spending Tracker Template on Notion

- Mental Health Tracker, A5 Printable Journal Page on Etsy

- Emotion Tracker Printable Personal Size Insert on Etsy

By turning mood into visible data, these printables encourage daily reflection and foster a habit of mindful spending.

Impulse Purchase Tracker: Oops, I bought it again

Emotional Spending Diary PDFs

For those who want a downloadable diary to keep all entries in one neat file, PDFs combine clarity and convenience. Print once, refill, or use a PDF app to enter your entries digitally.

Explore these notable PDF diaries focused on emotional spending:

- Body Budget Diary Chart – The Neurodiverse Universe

- Expense Diary PDF – Squarespace

- Spending Diary PDF – University of the West of Scotland

These structured diaries help you capture the interplay between your wallet and feelings in a professional, easy-to-follow format.

Downloadable Money & Mood Journals

Combining money habits with mood tracking, these journals show you what’s really happening beneath your impulse buys. They link emotional shifts with financial decisions in one seamless flow.

Check out these tools for a polished journaling experience:

- Mood Journal Printable on Pinterest

- Mood Journal Tracker App (iOS)

- Mood Journal: Emotions Tracker on Google Play

These encourage consistent mood logging, making it easier to notice emotional spending triggers over time.

Money Mood: A Budget Journal for Chaotic Babes Who Like Nice Things:

Free Emotional Spending Journals

Budget-friendly and effective, free journals give you a solid start without a price tag. They pack essential prompts and space for reflections that spark awareness.

Here are quality free options worth trying:

- How to manage emotional spending according to a recovering spender

- The Psychology of Emotional Spending – Psychology Today

- Research on emotional spending PDF

They introduce vital concepts and help you journal without distractions or fuss.

Emotional Spending Worksheet Templates

Worksheets zero in on challenging areas within your spending habit. They prompt you to analyze what drives you, then suggest strategies for healthier habits.

Try working through these focused templates:

- Create an Emotional Budget – Red River Counseling

- Emotional Spending Tracker Template – Notion

- Money Values Emotional Spending Worksheet on Etsy

These make reflection hands-on with guided questions and tracking fields.

The Feminist Financial Handbook: A Modern Woman’s Guide to a Wealthy Life

Spending Triggers Printables

Being aware of your main spending triggers is step one. Printables that focus solely on tracking triggers help you spot them quickly and react smarter.

Explore printables to map your spending triggers:

- Trigger List for Planners on Pinterest

- No Spend Challenge Worksheet

- My Spending Habits and Triggers PDF

These empower preemptive action before impulse strikes.

Habit Tracker for Spending PDFs

Tracking habits visually cements change. These simple PDFs help you mark daily wins and slipping points in your spending habits.

Some great trackers to try:

- Habit Tracker PDF – Ball State University

- 20 Free Printable Habit Tracker Templates

- Free Printable Habit Trackers on Pinterest

Small daily checks help turn awareness into action.

Financial Journal Printables

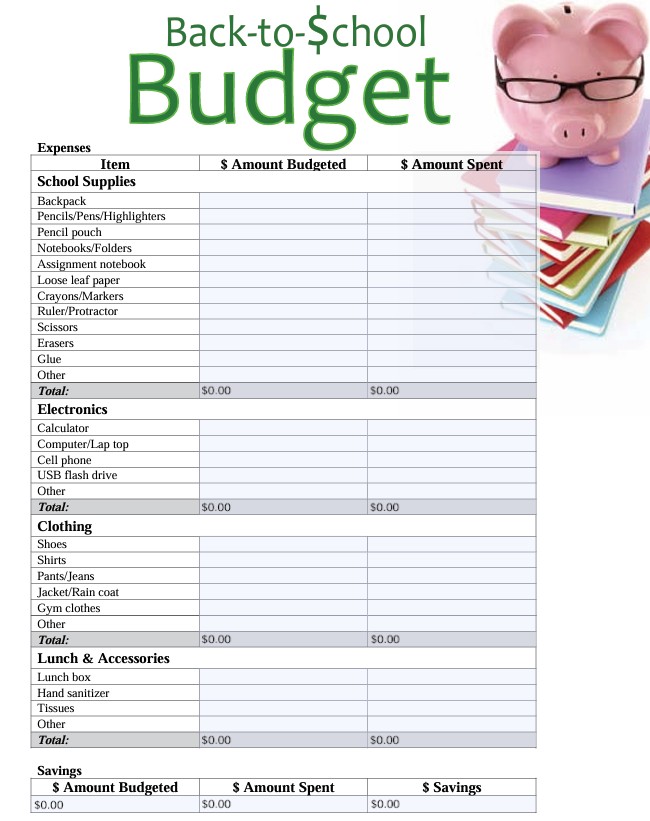

Want a journal that tracks income, expenses, and emotions all at once? These printables merge budgeting with emotional notes for a full-spectrum view of your money life.

Consider these useful printables:

- Canva Free and Customizable Budget Templates

- Printable Budget Templates A4, A5, Letter – OnPlanners

- Financial Journal Template on Pinterest

They add polish and precision to your emotional spending journal.

Ospelelf Budget Planner – Budget Book with Bill Organizer and Expense Tracker

Budget and Emotions Worksheets

Worksheets that link budgets to emotions sharpen your awareness around why money flows the way it does, especially when emotion enters the scene.

Try these resources:

- Create an Emotional Budget – Red River Counseling

- Emotions and Budgeting Worksheet Board on Pinterest

- Emotional Budgeting Workbook on Amazon

You get concrete help tying financial goals and feelings tightly together.

Photo by Anete Lusina

Templates and printables are your stylish sidekick in mastering emotional spending. They transform raw feelings and spending confusion into clear insights and manageable steps. Pull a few into your routine and watch awareness and control turn from distant goals into second nature.

Benefits & Success Stories

An emotional spending journal is more than just a place to jot purchases and feelings—it’s a spotlight illuminating how mood and money dance together. Keeping one unlocks clarity about your habits, giving you power to course-correct without harsh judgment. This section explores the real benefits of journaling your emotional spending, packed with inspiring success stories and examples from people who turned their shaky spending into mindful control. You’ll see how this simple habit reshapes both inner peace and bank accounts alike.

How an Emotional Spending Journal Helps

The key benefit? Transformation. By writing down the emotional backdrop of each buy, you’re not just tracking expenses—you’re uncovering patterns hiding in plain sight. This deeper insight acts like a guide, teaching you to pause before impulse hits. Many users find:

- Heightened self-awareness about triggers and moods

- Reduced guilt and regret, replaced by understanding

- More intentional spending decisions with clear emotional context

- Increased emotional intelligence regarding money management

- Better ability to strategize alternatives to retail therapy

For example, one recovering emotional spender shared how daily notes helped them spot stress as the biggest impulse trigger, which eventually led to healthier coping methods like meditation or calls to friends, reducing overspending.

Journaling Benefits for Financial Health

The upsides extend well beyond emotional calm. When emotional spending is on your radar, your financial health improves too:

- Clearer budget tracking aligned with emotional patterns

- Fewer surprise cravings turning into expenses

- **Ability to set personalized spending rules consciously

- Stronger routine for financial reflection and discipline

- Less overwhelm, as journaling breaks down habits into manageable chunks

One compelling story comes from a budgeting blogger who credited journaling for transforming their chaotic money life. After weeks of jotting their mood and buys, they cut discretionary spending by 40% and reallocated savings into a dream vacation fund, all without feeling punished.

Real Stories of Emotional Spending Recovery

Hearing how others conquered emotional spending can be a powerful motivator. For many, journaling was the first step in a journey from reactive spending to clarity, like:

- A woman who went from frequent late-night impulse buys to mindful self-care nights, tracked meticulously in her journal.

- A man who replaced celebratory shopping splurges with journaled affirmations and gratitude lists, leading to more joyful spending on meaningful goals.

- A client who used an emotional spending log in therapy, charting mood-related spending over months and finally breaking the guilt-spending cycle.

These stories emphasize that journaling isn’t a magic fix but a trusted mirror reflecting your money moods—and giving you control back.

Before and After Using an Emotional Spending Journal

The contrast is often striking. Before starting a journal, emotional spending can feel like a scripted nightmare of impulse and remorse. After consistently journaling, many report:

- Before: Shopping to numb or celebrate without thought.

- After: Purchasing aligned with genuine needs and goals.

- Before: Overdraft fees and hidden regrets.

- After: Confidence in spending choices and savings goals.

- Before: Feeling powerless over money mood swings.

- After: Recognizing emotional waves and steering clear of triggers.

One journaling enthusiast noted, “It was like switching from night to day—I began seeing my spending habits as stories I could rewrite instead of monsters to hide from.”

Improving Money Habits with Journals: Testimonials

Many users swear by journaling to rebuild trust with their money selves:

- “Writing down my feelings around purchases stopped me from overspending on clothes I didn’t even love.”

- “My journal taught me that most spending was about stress, not need. That awareness was freeing.”

- “The simple act of tracking helped me develop a slow spending habit. Now I buy with purpose.”

An insightful article also highlights how journaling creates lasting behavior change through gentle self-reflection rather than harsh rules, boosting both money management and self-compassion.

Soligt Budget Planner 2025, Monthly Budget Book Bill Organizer

Reviewing Progress in Emotional Spending

Regularly reviewing your journal entries turns vague intentions into clear progress. Flipping through entries over time reveals:

- Which emotional triggers fade away with coping strategies

- New spending habits taking shape in place of old reflexes

- Financial goals coming into sharper focus alongside emotional wellness

- Increased ability to predict and prevent impulse buys

One journal keeper described: “Looking back felt like watching myself grow. I could literally see the weeks I resisted the urge to shop, and it kept me going through tougher days.” Consistency here is key.

Photo by Melike Baran

Using an emotional spending journal brings a refreshing clarity: your money habits aren’t random acts but parts of your emotional landscape. By keeping track, you gain the power to change the narrative, swap guilt for understanding, chaos for calm, and impulse for intention. Real stories prove this approach works—and with practice, it will work for you.

Budget Planner – Monthly Budget Book with Expense Tracker Notebook

Related Mental Health & Personal Growth Topics

When you start tracking emotional spending, you tap into a broader conversation about how money intertwines with mental health and personal growth. Looking beyond transactions, you discover emotional patterns, stress points, and core beliefs influencing financial choices. This section highlights crucial topics closely linked to emotional spending journals. They paint a clear picture of how managing money is about more than numbers — it’s a pathway to understanding yourself better and gaining control over your habits.

Money and Emotions: Mental Health Connection

Money deeply affects mental health in ways that often go unnoticed. Stress around bills or debt can spiral into anxiety and depression, while spending habits sometimes become fast escapes from emotional pain. Emotional spending is a common coping mechanism, offering a quick, though temporary, mood lift.

- Money challenges can trigger feelings of panic, shame, or hopelessness.

- Emotional spending may mask underlying issues like loneliness or stress.

- Awareness of this connection is vital to breaking the cycle of impulsive purchases.

Mental Health Journals for Spending Awareness

Journals designed specifically for combining mental health tracking and spending habits help people stay mindful of how emotions shape money decisions. They typically blend prompts for mood, triggers, and reflections alongside expense logs, making it easier to see how feelings influence spending.

- These journals encourage identifying emotional triggers in a safe, structured space.

- They foster self-reflection that builds emotional intelligence around money.

- Examples include the Mind and Money Journal, which helps track emotions and budgeting on one platform.

Using a mental health-focused spending journal turns plain numbers into meaningful stories, shining light on patterns to change.

Spending and Anxiety Worksheets

Anxiety and financial habits often feed one another. Feeling anxious can create urgency to spend, while bills and budgets can amplify worry. Worksheets focused on money anxiety introduce exercises to identify triggers and build coping strategies.

- These include lists of money beliefs, calming techniques, and goal-setting practices.

- Worksheets offer concrete tools for calming racing thoughts linked to spending urges.

- For example, Therapist Aid’s My Relationship With Money worksheet helps uncover emotional spending behaviors and beliefs.

Incorporating anxiety worksheets with your journal work can transform overwhelming stress into manageable moments, reducing impulsive buys.

Emotional Intelligence and Financial Habits

Financial decisions are as much emotional as logical. Emotional intelligence (EI) — recognizing, understanding, and managing emotions — directly impacts money habits. Strong EI promotes rational spending, better decision-making, and increased financial confidence.

- People with higher EI tend to resist impulse buys and plan more effectively.

- Developing EI around money means tuning into feelings behind urges without judgment.

- Read more about how emotional intelligence shapes your financial future.

Journaling enhances this skill by making internal emotions visible and giving you room to respond thoughtfully instead of reacting blindly.

Self-Discovery Journal:

Stress Relief Spending Logs and Budgets

Stress is a prime trigger for impulsive buying sprees. Special budget planners and spending logs designed to manage stress focus on tracking not just how much you spend, but why. They encourage replacing spending as a stress reliever with healthier alternatives.

- Some tools blend expense tracking with stress relief exercises or mindfulness tips.

- Example: The Stress Less, Spend Less Budget Planner offers a year-long structured approach to calm spending pressures.

- These methods help catch spending patterns tied to emotional overload before they spiral.

By logging stress alongside purchases, you gain clarity and control, turning momentary tension into intentional self-care.

Money Therapy Journal Prompts

Targeted journal prompts act like gentle guides toward healthier money habits. Money therapy prompts focus on feelings, childhood money stories, and values behind spending, encouraging deeper self-awareness.

- Prompts include exploring your earliest money memory or identifying how financial stress shows in your body.

- They can surface hidden beliefs that drive overspending or hoarding habits.

- For practical ideas, see Money Affirmations Journal: Manifest Wealth & Abundance

Incorporating therapy-style prompts into your emotional spending journal adds depth, transforming notes into a tool for healing and growth.

Linking Money and Self-Esteem

Your relationship with money often reflects your self-esteem layers. Higher income can boost self-confidence, but only if linked to a positive self-view rather than external validation. Emotional spending sometimes compensates for low self-worth, creating an unhealthy loop.

- Improving your money-esteem connection means recognizing how money affects your sense of worth.

- Studies show people with higher incomes tend to have higher self-esteem, but the real gain is cultivating a healthy money-self relationship independent of wealth.

- Journals focused on self-esteem and money highlight progress beyond just balance sheets.

By tuning into this link, emotional spending journals help rebuild confidence that nurtures both your wallet and your self-image.

I’m good with money Journal:

Emotional Self-Care Money Journals

Self-care includes emotional care around spending. Journals that blend self-care routines with money tracking encourage spending that truly supports well-being rather than masking discomfort.

- They prompt reflections on whether purchases feel like true care or quick fixes.

- Financial self-care journals push for mindful investment in experiences or essentials, over mindless splurges.

- Example: The Financial Self-Care Journal emphasizes balance between mindfulness and good budgeting.

Integrating emotional self-care into your money journal builds habits that fuel long-term happiness, not short-lived highs.

Counseling Tools for Overspending

For deeper challenges, counseling tools provide structured approaches to manage overspending behaviors. These include worksheets, exercises, and therapeutic techniques to uncover emotional roots and develop healthier habits.

- Techniques often target impulse control, emotional triggers, and healthy financial boundaries.

- Resources like the BetterHelp article on coping with compulsive spending offer guidance on therapy and self-help options.

- Using such tools alongside journaling strengthens your ability to break cycles.

Professional support and tools boost journaling’s impact by providing frameworks tested in clinical settings.

Good Things, Emotional Healing Journal: Addiction

Managing Overspending and Depression

Depression can intensify emotional spending by lowering motivation and increasing the urge to seek comfort in purchases. Recognizing this link is key to effective management.

- Overspending during depressive episodes often seeks temporary mood boosts but creates longer-term problems.

- If journaling reveals spending tied to depressive moods, professional help can guide healthier coping.

- See Mind UK’s overview of money and mental health for support strategies.

Managing emotional spending in the context of depression requires kindness, patience, and tools that address both financial and mental health.

Wellness Journal

Exploring these linked subjects adds real depth to your emotional spending journal practice. Beyond tracking purchases and moods, you develop self-knowledge, emotional strength, and a personalized bridge to healthier money habits and mental wellness. Take advantage of specialized journals, worksheets, and professional resources to make your journey both stylish and steady.

Financial Coaching & Budgeting

When you’re tackling emotional spending, financial coaching paired with smart budgeting acts like your personal style consultant but for money. It helps you create a wardrobe of financial habits that fit your lifestyle and emotional rhythms—no squeezing or stressing. Think of coaching and budgeting as the perfect duo: coaching helps you get clear about your financial values and emotional triggers, while budgeting puts that clarity into practical steps you can actually stick to.

Financial coaching is designed to support, not judge. It’s where a coach listens deeply to your money story, points out your spending patterns, and offers strategies that honor both your emotional needs and financial goals. When emotion pushes you toward spontaneous shopping, a tailored budget crafted with coaching insight becomes your steady runway, helping you walk confidently past the impulse.

Let’s break down how financial coaching and budgeting work hand in hand to help you own your emotions and money game.

How Financial Coaching Supports Emotional Spending

Emotional spending is personal, sometimes messy, and often loaded with feelings money management books don’t cover. That’s where coaching shines:

- Personalized Insight: A coach helps you uncover hidden triggers behind your spending habits, translating vague feelings into clear action steps.

- Healthy Boundaries: They assist in setting financial boundaries—kinda like defining your outfit limits, but for your wallet—to keep impulse buys in check without losing joy.

- Goal Setting with Heart: Instead of one-size-fits-all budgets, coaching tunes spending plans to your values, so you’re not just surviving financially but thriving emotionally.

- Accountability Partner: You get support that keeps your progress real and on track, helping you avoid old spending habits sneaking back like last season’s trends.

The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace

Budgeting After Emotional Spending: Crafting Your Signature Look

Budgeting doesn’t have to mean depriving yourself. It’s about designing a spending plan that respects your emotional backdrop and financial realities like a well-tailored jacket—functional and flattering.

Start by recognizing emotional spending as part of your style story, not your whole look. Build:

- Flexible Categories: Allocate a small “feel-good” fund within your budget for those rare splurges, so your budget breathes instead of constricts.

- Trigger-Aware Limits: Set spending caps when moods run high—like limiting late-night online shopping or unplanned takeout runs.

- Regular Check-Ins: Weekly or monthly reviews let you adjust the budget to stay in sync with your ever-changing emotional climate.

- Emergency Plans: Create an emotional spending emergency stash, a buffer that avoids guilt while honoring needs for self-comfort.

A fresh take on budgeting, blended with emotional intelligence, translates to better control and fewer regret moments. For practical budgeting strategies and emotional spending,

Blending Budget Planners with Emotional Awareness

Why settle for a rigid spreadsheet when you can have a budget planner that feels more like a journal than a calculator? Mixing money tracking with emotion notes allows you to spot patterns at a glance.

Look for planners that include space for:

- Mood Tracking: Record how you felt before spending.

- Triggers: Note what precipitated the purchase (stress, boredom, celebrations).

- Reflections: Capture thoughts post-spend to understand emotional impact.

These planners turn budgeting into a dynamic, self-aware habit. They combine numbers with narrative, turning your budget from cold digits into a story about you—your values, your moods, your goals.

For planners that work this way, check out the “2025 Mood Tracker Planner” available on Amazon.

When Budget Tracking Meets Emotional Awareness

Budget tracking becomes truly powerful when layered with emotional insights. Tracking every dollar sheds light on what you spend, but tossing in your emotional state reveals why.

The combined approach:

- Highlights when emotional spending spikes, like evenings or weekends.

- Encourages building alternatives for high-risk times.

- Turns boring number crunching into an engaging self-discovery.

Apps and journaling templates with dual functions exist to help sync tracking with feelings. For example, Emotional Spending Tracker Templates offer an elegant mix of budgeting and emotional reflection that makes chronic overspending easier to tame.

Spending diary: Track your emotions whilst spending

Combining Envelope Budgeting with Emotion

The envelope method, where you allocate cash for expenses into physical envelopes, gains a whole new dimension when paired with emotion tracking. Visualizing your money physically disappearing can tame impulsive buying, especially when you’re emotionally charged.

Try these tweaks for emotional spending:

- Label envelopes not just by category but by mood triggers (e.g., “Stress Relief,” “Celebration”).

- Use a small fun fund envelope to honor emotional needs but keep limits clear.

- Before spending from a trigger envelope, pause and journal the feeling driving the urge.

This approach keeps spending tangible and purposeful, enhancing self-control with a dose of emotion-awareness. Budget Envelopes for Cash System

Financial coaching and budgeting work best when they embrace the messy, real parts of your emotional life. Together, they help you trade chaotic impulse spending for a self-designed money routine that looks and feels just right. By tuning into your feelings and pairing them with thoughtful planning, you craft a financial style that’s both smart and deeply you.

For coaching and budgeting tools that support this blend, apps and templates abound to make your journey clearer and more stylish. Whether through journaling prompts, emotion-aware budget planners, or supportive coaching relationships, you’ll find your unique path to financial ease and emotional balance.

Children & Teen Education

Teaching kids and teenagers about money is about more than numbers—it’s about feelings, choices, and building a healthy relationship with spending. Emotional spending isn’t just an adult challenge; kids absorb money signals early. Sparking emotional awareness around money in young minds sets a foundation that can prevent impulsive splurges later on.

By blending money lessons with emotional education, parents and educators give children tools to reflect on their feelings before hitting “buy.” This style of education invites young people to pause and consider, “Is this purchase about what I truly want or just a quick fix for my mood?” It’s a mindset that’s stylishly smart—knowing the difference between need and feeling without shaming curiosity.

Teaching Kids About Emotional Spending

Kids respond best when lessons are interactive and relatable. Instead of dry talks about budgets and bills, bring emotional spending to life with simple language and playful activities. For example:

- Use jars or piggy banks as “emotion wallets”. Let children sort money into jars labeled with emotions like happiness, stress, or boredom. This hands-on activity helps illustrate how money can reflect feelings.

- Create stories or role-play scenarios showing what happens when spending is driven by moods.

- Ask questions that teach reflection, such as “How does this toy make you feel before and after buying it?”

This method builds self-awareness and helps kids recognize urges linked to feelings rather than needs. Over time, they learn to pause and think, not just spend.

For deeper insights on social and emotional money education, Financial Literacy for Kids: offers valuable tips that link self-awareness to money habits.

Emotional Spending Lessons for Teens

Teenagers face a new world of spending choices and peer pressures. Emotional spending can hide behind trends, social media ads, and the need for approval. Teaching teens to journal about their spending emotions unlocks a clear path to mindful decisions.

Try these teen-friendly strategies:

- Introduce a money mood tracker: A simple journal or app where teens record each purchase alongside their emotional state.

- Offer guided prompts: Questions such as:

- What made me want to buy this?

- Was I feeling stressed, bored, or excited?

- How did I feel afterward?

- Discuss real-life scenarios: Analyze popular spending traps like peer-driven shopping or “retail therapy” to surface emotional triggers.

- Encourage setting spending goals linked to values: Tap into what matters most to them, making spending feel aligned with identity rather than impulse.

These exercises empower teens to own their money story, turning emotional spending from a sneaky pattern into an intentional act. More on youth emotional finance can be found in youth financial literacy resources for a rich curriculum. Money Skills for Teens:

Money Mindsets for Children Through Journaling

Journaling money feelings might sound like an adult habit, but it can be a stylish entry point for children. Simple daily prompts about their spending and saving feelings teach kids to identify emotions clearly and put them into words.

Sample prompts:

- Which purchase made me happy today?

- Did I want to buy something because I felt lonely or bored?

- What could I do instead of spending money when I’m feeling sad?

Use colorful journals or apps designed for kids, making this a creative routine rather than a task. This practice boosts emotional intelligence and builds a habit of reflection early on.

Pairing journaling with discussions about money and feelings offers a powerful way for kids to connect emotional dots around spending without being lectured.

Happy Confident Me: Daily JOURNAL

Family Activities with Emotional Spending Journals

Turning emotional spending education into a family event adds fun and accountability. Here are energizing ideas:

- Family money mood check-ins: Regular sit-downs where everyone shares spending feelings from the week.

- Create a joint emotional spending journal: Each family member adds notes about their spends and mood triggers.

- Play money and feelings games: Use cards or apps that highlight different emotional spending triggers and healthy alternatives.

- Set monthly challenges like “no emotional buys weekends” and celebrate wins with special rewards.

These activities weave emotional spending awareness into family life, making it as natural as sharing a meal. It also fosters connection around money, which is often a touchy topic.

Emotional Awareness Money Tracker for Students

Schools can add flair by incorporating emotional awareness into financial lessons. Simple worksheets that combine mood tracking with spending logs offer students a dual lens on money and emotion.

Features might include:

- Smiley/frowny faces to mark moods before spending.

- Sections capturing purchase reason linked to feelings.

- Space to brainstorm alternative reactions to emotional triggers.

These trackers encourage mindfulness in spending and make classroom money talks more vivid and relatable. Tools like these can be found in youth finance programs dedicated to mindful spending education.

Kids Money Journal Prompts

Journals shaped by thoughtful prompts can guide kids through emotional spending learning smoothly:

- When did I feel like spending today?

- What emotion did I want to change by buying?

- Did I save or spend today, and how did that make me feel?

- What’s one thing I want instead of buying right now?

With these, kids create a personal dialogue around their money choices. This empowers them to pause, reflect, and build lasting habits grounded in emotional clarity.

Teaching children and teens about emotional spending isn’t just preparation for managing money—it’s preparation for managing life. When feelings and money mix, clarity becomes your best accessory. Building this skill early means your young ones won’t just follow trends—they’ll define their own confident, mindful money styles. For more ideas on talking money with kids, Child Mind Institute’s guide to money talk offers practical advice and fresh perspectives that resonate with families today.

Digital Tools & Apps

Journaling your emotional spending can sound charming on paper, but keeping it consistent? That’s where digital tools and apps step in like your ultra-stylish sidekick. These platforms make tracking your moods and money moves slick, simple, and surprisingly revealing. Forget bulky notebooks or scattered notes—modern apps combine ease and insight, helping you catch on to patterns faster and with less fuss.

When your feelings and finances intersect, these digital companions transform emotional spending journals from a good idea into a daily habit you actually look forward to. Whether you’re aiming to log every impulse buy or just want a quick mood check before shopping, the right tool brings clarity to chaos—in a way that fits seamlessly into your life.

Best Emotional Spending Journal Apps

Picking the right app can feel overwhelming. You want one that’s intuitive, fairly discrete, and tailored for capturing emotions alongside dollar signs. Here’s a curated list capturing the spirit of mindful money tracking with an emotional twist:

- Daylio: A winner for mood tracking that doubles as a journal. Its icon-based mood selector makes logging feelings alongside spending quick and visual.

- Reflection: This app pairs AI-powered prompts with privacy-first journaling, offering gentle nudges to explore why you spent, not just what you did.

- Allo: Mindful Money Tracker: Tag your expenses by emotional context, flag impulsive buys, and get guided insights to shift spending behaviors.

- Diarly: Private diary meets mood tracker with smooth calendar integration, perfect for daily financial reflection with emotional notes.

- Mint: While primarily a budget tracker, Mint’s categorization and spending alerts add context to your habits, helping reveal emotional spending zones.

Tools like these don’t just log—you start building a habit of awareness, turning fleeting feelings into actionable money insights. They fit neatly on your phone, ready to catch the smallest spending urge or mood shift before it grows into a pricey regret.

Digital Mood Trackers for Spending

Connecting moods to money takes finesse, and mood trackers built with spending in mind make the job cleaner and smarter. These apps let you:

- Track your emotional state before and after spending.

- Visualize mood fluctuations tied to your purchase patterns.

- Identify quick fixes versus meaningful spending moments.

Some top picks include Moodfit, beloved for its easy interface that tracks multiple moods and habits, letting you see how feelings and spending sync. Another is Mental Walk, a minimalist option with a focus on journaling moods simply but effectively.

Apps to Log Money and Feelings

Gone are the days when spending was just numbers on a spreadsheet. Today’s apps want your thoughts, feelings, and motivations. Logging money alongside mood invites reflection and helps disentangle impulse buys from intentional spending. Apps like:

- MyMoney: Track expenses, budget, and add notes reflecting how purchases felt, merging financial oversight with emotional detail.

- Copilot Money: Offers detailed spending insights plus support for tagging purchases emotionally, so you get a real snapshot of your spending psyche.

These options feel less like chores and more like stylish financial companions, keeping your money story alive with context.

Journaling Apps for Mindful Spending

If writing your thoughts helps you process emotion-driven buys, journaling apps with prompts and reminders boost your self-awareness effortlessly.

Top contenders:

- Day One: A sleek and secure journal app with rich multimedia options, perfect for capturing emotional layers behind spending.

- Journey: Combines journaling with mood logs, helping you connect the dots between feelings and finances.

- Reflection: AI-powered, this app suggests probes to understand your spending triggers deeply.

These apps nudge you to pause, reflect, and grow, so every entry feels more like a style statement for your financial wellness rather than a task.

Online Emotional Spending Trackers

Prefer web tools to apps? Online trackers let you log spending and mood without downloading anything, often with templates or dashboards that visualize your money moods.

Try:

- Notion’s Emotional Spending Tracker Template: Combines detailed tracking with an elegant design for budget and mood side-by-side.

- Allo Mindful Money Tracker: Works both online and mobile, focusing on tagging purchases by emotional triggers and values.

Web trackers offer flexibility and accessibility, no matter where you are, making it easier to keep tabs on your emotional spending habits.

Daily Digital Financial Reflection

Making time for financial reflection is key, and apps dedicated to this practice transform daily pause into a rich habit. You can review your spend, moods, and triggers all in one place, turning a few minutes into momentum.

Popular choices:

- Financial Reflection Planners (Etsy): These bundles combine digital pages for structured daily review, goal tracking, and emotional check-ins.

- Reflection.app: Offers guided journaling focused on work and finance, with prompts designed to deepen understanding of spending patterns.

A few minutes spent reviewing your finances with emotional awareness reshapes how you approach money—not with stress, but with stylish confidence.

GoGirl Planner and Organizer for Women

Tech Tools for Financial Awareness

Tech tools extend beyond apps to include budgeting platforms, trackers, and even AI assistants that heighten your financial mindfulness without overwhelming you.

Examples in the spotlight:

- Mint.com: Integrates banking, budgeting, and spending alerts with clear summaries that uncover emotional spending hotspots.

- Copilot Money: Adds a layer of emotional context to budgeting, helping you stop unconscious overspending.

- Moodfit: Tracks moods alongside habits, delivering personalized insights on how your emotions sway your spending.

These tools turn abstract money worries into clear visuals and action plans, giving you control over impulse shopping and a roadmap to financial peace.

Photo by Karolina Grabowska

Digital tools and apps are the perfect fashion accessory for your emotional spending journal. They bring structure, insight, and a dash of elegance to your efforts, helping you stay stylishly in control of your money moods. Explore the options above to find the perfect fit for your lifestyle and start tracking with confidence today.

An emotional spending journal transforms how you see your money and yourself.

An emotional spending journal transforms how you see your money and yourself. By tracking feelings alongside purchases, you reveal hidden patterns that fuel impulse buys and stress. This practice brings clarity—not just to your budget, but to your emotional world.

Starting your own journal opens the door to smarter decisions, less regret, and a healthier relationship with money. It sharpens self-awareness, eases anxiety, and builds a spending style that fits your real needs, not fleeting moods.

Keep the pages turning and reflections coming. Growth isn’t instant, but every entry moves you closer to financial confidence wrapped in emotional balance. If your money habits have felt out of control, this simple habit offers control—and a fresh sense of freedom.

Ready to begin? Your wallet—and your well-being—will thank you for it.

Affiliate Links: The items live on repeat in my closet or on my desk. The items I do not have yet are ones I’m saving for. Shop them via the links above. If you decide to swipe something for yourself, I may get a small thank-you in the form of coffee money ☕—no extra cost on your end, just a little perk for sharing things I swear by. ☕️✨