Every August, stores burst with notebooks, new sneakers, and reminders that back-to-school prep isn’t just about picking out a few fresh pencils. For most families, stocking up on supplies, buying clothes, and enrolling kids in activities is a huge expense. On average, parents spend around $586 per child just on school fees — and that doesn’t even include the $582 many fork over for extracurriculars. Add it up for two or three kids and you’re not buying a new backpack—you’re buying a new bill.

The pressure to give your children every opportunity can clash with the realities of your wallet. That’s why a bit of planning—simple, honest, nothing fancy—can make a huge difference. When you have a roadmap, you cut overspending, dodge financial stress, and set yourself and your kids up for a successful school year.

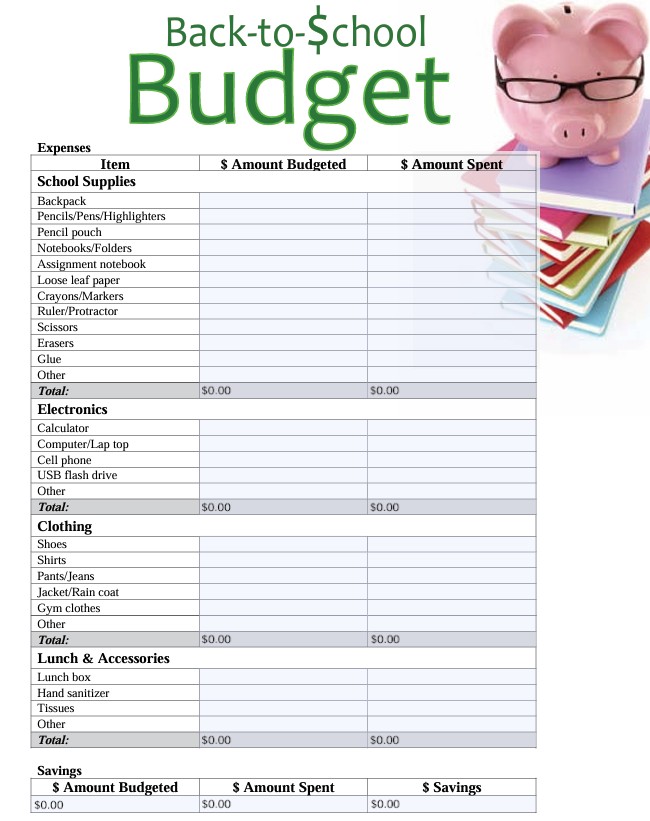

Forms are located in the Downloads folder.

Parents often think tuition covers everything. Spoiler: it doesn’t. In both public and private schools, you’re often hit with a parade of “extras.”

Let’s break it down:

- Uniforms and dress codes: The never-ending cycle of too small, too soon.

- Technology charges: Tablets and laptops rarely come free. There’s usually a “technology fee” hiding in the fine print.

- Activities and clubs: Sports, band, and debate come with costs for materials, travel, and uniforms.

- Academic extras: Field trips, school supplies, lab fees, and art supplies can add up.

Saving on School Supplies & Uniforms

Opening that supply list feels a lot like opening your phone bill after an international trip. One page in, you wonder where it all went wrong. But with some strategy, you can check off even the biggest supply list without gutting your bank account.

Creating a Realistic Budget Plan

Start by listing every possible expense. Yes, every single one: pencils, markers, tabs, lunch boxes, sports shoes, band fees, costumes for drama club. It’s tempting to ballpark the numbers, but vague guesses lead to surprised faces (and bank account overdrafts).

Tips for building a solid budget:

- Break your list into “essentials” (must-haves) and “nice-to-haves” (wait and see).

- Use free budget tools like Mint, YNAB (You Need a Budget), or even a printable worksheet. Most have categories you can customize for school.

- If you’re unsure how much to put aside for each category, ask other parents or check last year’s receipts.

- Build in a little cushion for forgotten items. Kids have a talent for surprising you (“Mom, I need yellow socks for spirit week by tomorrow!”).

Tracking costs in real time may sound tedious, but it gives you control. You see where the bulk of money is headed—and where you might be able to trim.

Shopping Strategies: Sales, Coupons, and Bulk Buying

A few tricks can keep your cart light and your costs down:

- Shop the sales cycles: Retailers start pushing school deals in July and again in late August. Stock up on core items when they’re at their lowest price.

- Use digital and paper coupons: Sometimes it feels old-school, but those dollar-off deals add up.

- Stack discounts: Some stores let you combine coupons with sale prices. Don’t leave money on the table.

- Buy in bulk: For items your family goes through quickly (glue sticks, composition books), talk with other parents or neighbors about splitting a bulk purchase from warehouse stores.

- Take advantage of tax-free weekends: Many states offer tax-free shopping on clothing and school supplies in late summer.

A friend of mine started hosting a “school supply swap” in her driveway every August. Families bring extras, leftover from previous years, and everyone leaves with something they needed—and a little money saved.

Back to School Uniforms or Clothes

Some schools require uniforms. Others let kids wear what they want (within reason). Either way, clothing is a major slice of the budget pie.

- For uniforms, check if your school has a resale closet or secondhand options on campus. Many schools collect gently used uniforms for families to buy at a big discount.

- For street clothes, stick with simple basics that mix and match. Prioritize sturdy shoes and outerwear—they get heavy use and worn quickly.

- Hold off on buying all fall weather clothes at once. Kids might grow by October, and stores will drop prices further as weather cools.

One practical idea: buy a size up if your child is growing fast, or look for elastic waists and adjustable features that fit longer. (My oldest wore the same jacket two years in a row, thanks to a cleverly hidden drawstring.)

Secondhand Options and Clothing Swaps

Thrift and consignment stores are a treasure trove at back-to-school time. Shopping secondhand isn’t just cheaper—it often means better quality for the price (and you skip the fast-fashion landfill guilt).

- Check online: Facebook Marketplace, Poshmark, and local buy-nothing groups often have gently worn school clothes, backpacks, and shoes.

- Organize a swap: Coordinate with your school PTA or community group. Even a few families swapping gently-worn items can save big bucks for everyone.

- Sell what you outgrow: Use money from selling your child’s old clothes to offset this year’s purchases.

One parent in our neighborhood set up a “pop-up swap” using folding tables and cardboard signs at the park. It built community, cleared out closets, and sent more than one happy kid home with “new-to-them” sneakers.

Budgeting for Extracurricular Activities and Fees

Sports, art classes, and after-school programs add not only fun and skill-building but also a notable bump to your back-to-school budget. It’s easy to get caught off guard—registration fees, gear, uniforms, field trips—all stack up fast.

Understanding and Prioritizing Activity Fees

Sit down and list out every possible fee for the year. Think broad: soccer, band, STEM clubs, dance, tutoring. These often get announced after school starts, but a little research up front goes a long way.

- Ask your child’s school for a calendar of known activity fees. Coaches, teachers, or club leaders may have estimates.

- Rank activities by family priorities. Which ones offer the most value or most fun? Sometimes tough choices are needed if the budget is tight.

- Look for alternatives: Local park programs or community centers sometimes offer lower-cost sports and art programs.

- Find fee waivers or scholarships: Many schools and leagues provide help for families who ask—though you might need to be proactive about requesting it.

If equipment is the issue, reach out to your team or club. Pass-downs and shared supplies are common, and many parents are happy to send gently-used gear to a new home.

Back-to-school season is loud, busy, and—if you approach it honestly—a big financial puzzle for most families. But there’s no need to start September with buyer’s remorse or a string of overdraft fees. A clear budget, prioritized list, and a few shopping hacks make the difference between stress and success.

Start the season with a talk—about family priorities, needs, and ways to save. Reach out to other parents, trade tips, and organize swaps. You’re not just buying supplies or paying fees; you’re setting your kids (and yourself) up to face school and activities with confidence, balance, and a little more money in your pocket.

Remember: a little preparation now means more opportunities, fewer headaches, and a smoother start to the school year for everyone.