When my husband was diagnosed with Type 2 Diabetes and put on cholesterol and blood pressure medicine, Thanksgiving suddenly felt like a math problem. I started going through every single one of our favorite holiday dishes and asking, “Where is the sugar? Where are the carbs? What can I swap so this still tastes like Thanksgiving?” Little by little, I began turning our old recipes into Frugal Sugar Free Thanksgiving Recipes that did not wreck his blood sugar or our grocery budget.

Category: Saving Money

The Frugal Ones blogs on saving money with practical tips, honest stories, and expert advice. Simple steps and real-life examples make each post worth reading.

100 Budget-Friendly Meals Under $3 (Tasty Ideas Kids Love)

Finding meals that are easy on your wallet, quick to make, and actually eaten (without a fight) by kids can feel impossible. These days, feeding a family of four for less than $3 a meal almost sounds like wishful thinking, but I’ve made it my mission to prove it’s not only possible, but it can also be delicious and fun. This article pulls together 100 budget-friendly meals under $3 that fit those exact needs: they’re budget-friendly, take under 30 minutes, and pass the all-important kid taste test.

Payoff Made Simple with this Debt Snowball Tracker [PDFs Included]

Ready to see your debt shrink, month after month, without feeling overwhelmed? Many people set out to pay off loans with good intentions but lose steam along the way. The secret to crushing debt is as much about psychology as it is about math. That’s where the debt snowball tracker shines. When you combine this approach with a simple visual tracker—like the free printable PDFs linked below—staying on track becomes easier and even a bit more satisfying.

Simple Routines That Make Your Monthly Budget Planner Actually Work

Most people start a monthly budget planner with high hopes. But let’s be honest, it’s easy to fall behind once daily life gets busy. Missed bills, forgotten expenses, and the temptation of a last-minute takeout order can throw off even the most detailed plans. The truth is, the magic isn’t in the planner itself, but in the routines you set up to make it work. Here’s how to build habits that turn your budget into a tool that actually helps you take control of your money—with less stress.

Financial Planning: Smart Ways to Organize Your Money [2025 Edition]

Financial planning in 2025 feels more complex, with prices climbing and markets swinging, yet there’s […]

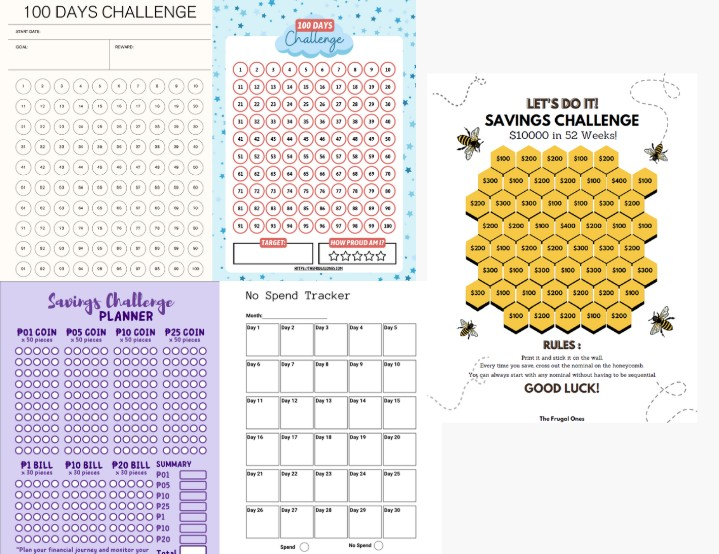

Simple Savings Challenges for Busy People with Tight Budgets

Saving money on a tight budget feels a bit like juggling while running late. Time is short, cash is tight, and most days, the idea of putting something aside seems out of reach. But here’s the thing: you don’t need a complicated spreadsheet or a big income to start growing your savings. By using a few simple savings challenges, those tiny changes can turn into real progress, all without giving up your morning coffee or staying up late budgeting.

Quick Guide: How To Make a Beginner Meal Plan [2025]

Making a meal plan sits at the sweet spot between saving money and eating well. For beginners, the idea can feel daunting, maybe even impossible, especially with busy routines and tight budgets. But, in my own experience, breaking things down into small steps makes the process easier (and a lot less stressful). Meal planning helps stop the endless cycle of last-minute takeout, surprising you with how much time, money, and mental energy you can actually save.

Find More Free Time with an Organized Grocery List

A chaotic grocery trip can eat up hours in an already packed week. If you feel like your shopping routine drains your energy and wastes precious time, a better system might be all you need. An organized grocery list isn’t just about remembering the milk; it’s an easy step that buys you more free hours each week. By planning before walking into the store, you skip the unnecessary laps around crowded aisles, cut down on last-minute decisions, and steer clear of dreaded impulse buys. Streamlining your grocery shopping frees up your schedule, leaving more space for the things that matter most.

Free Savings Tracker Downloads that Make Saving Money Simple

Saving money can feel like running in place, but tracking your progress changes everything. A free savings tracker puts the numbers in front of you, making it easier to see your wins, spot waste, and stick with your goals—even when life gets busy.

Free Savings Tracker Download that Makes Saving Money Simple

Saving money often feels harder than it needs to be. Life gets busy, temptations pop up, and sometimes, the numbers just don’t add up. A free savings tracker download can make all the difference. With one simple printable or digital tool, you get a clear way to set goals, monitor progress, and really see your money habits. No steep learning curve, no expensive software—just a proven way to make saving fun and more rewarding.

![Payoff Made Simple with this Debt Snowball Tracker [PDFs Included]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-001921.jpg)

![Financial Planning: Smart Ways to Organize Your Money [2025 Edition]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-003032.jpg)

![Quick Guide: How To Make a Beginner Meal Plan [2025]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-28-013321.jpg)