Ready to see your debt shrink, month after month, without feeling overwhelmed? Many people set out to pay off loans with good intentions but lose steam along the way. The secret to crushing debt is as much about psychology as it is about math. That’s where the debt snowball tracker shines. When you combine this approach with a simple visual tracker—like the free printable PDFs linked below—staying on track becomes easier and even a bit more satisfying.

Category: How to Save Money

The Frugal Ones shares real money-saving tips, practical budget strategies, and honest thoughts from daily life. Learn how small changes add up over time.

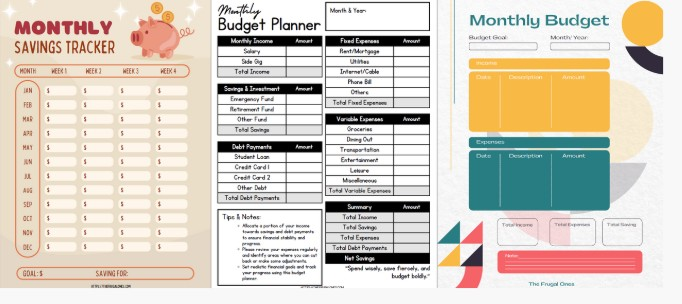

Simple Routines That Make Your Monthly Budget Planner Actually Work

Most people start a monthly budget planner with high hopes. But let’s be honest, it’s easy to fall behind once daily life gets busy. Missed bills, forgotten expenses, and the temptation of a last-minute takeout order can throw off even the most detailed plans. The truth is, the magic isn’t in the planner itself, but in the routines you set up to make it work. Here’s how to build habits that turn your budget into a tool that actually helps you take control of your money—with less stress.

Find More Free Time with an Organized Grocery List

A chaotic grocery trip can eat up hours in an already packed week. If you feel like your shopping routine drains your energy and wastes precious time, a better system might be all you need. An organized grocery list isn’t just about remembering the milk; it’s an easy step that buys you more free hours each week. By planning before walking into the store, you skip the unnecessary laps around crowded aisles, cut down on last-minute decisions, and steer clear of dreaded impulse buys. Streamlining your grocery shopping frees up your schedule, leaving more space for the things that matter most.

Free Savings Tracker Downloads that Make Saving Money Simple

Saving money can feel like running in place, but tracking your progress changes everything. A free savings tracker puts the numbers in front of you, making it easier to see your wins, spot waste, and stick with your goals—even when life gets busy.

Free Savings Tracker Download that Makes Saving Money Simple

Saving money often feels harder than it needs to be. Life gets busy, temptations pop up, and sometimes, the numbers just don’t add up. A free savings tracker download can make all the difference. With one simple printable or digital tool, you get a clear way to set goals, monitor progress, and really see your money habits. No steep learning curve, no expensive software—just a proven way to make saving fun and more rewarding.

The Best Free Monthly Budget Planners for 2025 [Updated]

Tracking your money month by month isn’t just smart, it’s how you stay in control when prices seem to change overnight. I’ve found that using a free online budget planner takes the guesswork out of saving, and honestly, there’s something really satisfying about seeing where every dollar goes (plus, it’s one less thing to stress about at night).

Honest Talk: How to Spot when a Shopaholic Turns into a Serious Disorder in 2025

Swiping up on endless new arrivals, dropping a cart full of sparkly must-haves, smiling at that dopamine hit from a designer logo—being a “shopaholic” feels fun, maybe even a little glamorous. Fashion and pop culture have turned over shopping into a punchline or a badge, with binge-buying framed as self-care, rebellion or even creative expression. But behind the chic bags and bubbling excitement, a real question emerges: when does the spree stop being harmless and start to signal something deeper? When the Shopaholic Turns into a Serious Disorder.

Best Journals of 2025 to Track Emotional Spending and Build Better Money Habits

Ever found yourself swiping your card as a quick fix for a mood? How to track emotional spending — it’s that impulse to shop when joy, sadness, or stress hit hard? Ever found yourself shopping online when you are bored? Money and mood weave together, often twisting logic with a powerful rush of feeling.

How to Make a Christmas Budget (And Still Have Fun)

The holidays should feel joyful, not stressful. But let’s be honest—between gifts, decorations, and festive meals, it’s easy to spend more than you should during Christmas. Money worries can suck the fun out of the most wonderful time of the year. That’s why setting a Christmas budget can be the best gift you give yourself. Ramsey Solutions is a trusted name for getting your finances in order. Their EveryDollar tool makes it simple to track spending and avoid post-holiday regret.

How to Make DIY Dishwasher Tabs That Actually Work [Step-by-Step Guide]

Dishwasher tabs seem small, but their cost, plastic wrappers, and long ingredient lists add up. That’s why many people make their own. With a few common kitchen items, you can easily create dishwasher tabs at home. They clean just as well as store-bought ones, use fewer chemicals, and let you feel better about running your dishwasher. Most DIY dishwasher tabs use simple ingredients like baking soda, citric acid, and salt, with a bit of dish soap for extra cleaning power. Want your dishes to smell fresh? Add some essential oils. Making your own tabs saves money and puts you in control of what cleans your dishes. It’s a smart choice for your budget, your home, and the planet.

![Payoff Made Simple with this Debt Snowball Tracker [PDFs Included]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-001921.jpg)

![The Best Free Monthly Budget Planners for 2025 [Updated]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-26-235438.jpg)

![How to Make DIY Dishwasher Tabs That Actually Work [Step-by-Step Guide]](https://thefrugalones.com/wp-content/uploads/2025/06/Screenshot-2025-06-15-025339.jpg)