Ready to see your debt shrink, month after month, without feeling overwhelmed? Many people set out to pay off loans with good intentions but lose steam along the way. The secret to crushing debt is as much about psychology as it is about math. That’s where the debt snowball tracker shines. When you combine this approach with a simple visual tracker—like the free printable PDFs linked below—staying on track becomes easier and even a bit more satisfying.

Category: Managing Money

The Frugal Ones share stories and tips on managing money with real-life advice, expert input, and small changes that add up (sometimes quicker than you think).

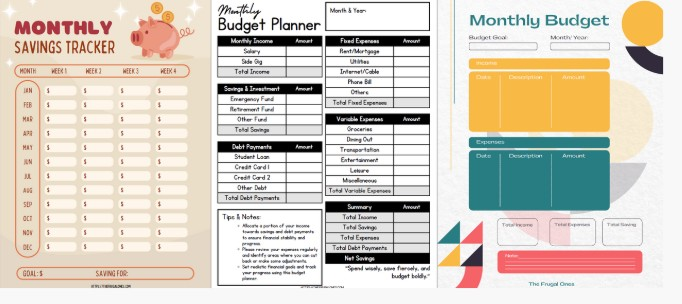

Simple Routines That Make Your Monthly Budget Planner Actually Work

Most people start a monthly budget planner with high hopes. But let’s be honest, it’s easy to fall behind once daily life gets busy. Missed bills, forgotten expenses, and the temptation of a last-minute takeout order can throw off even the most detailed plans. The truth is, the magic isn’t in the planner itself, but in the routines you set up to make it work. Here’s how to build habits that turn your budget into a tool that actually helps you take control of your money—with less stress.

Financial Planning: Smart Ways to Organize Your Money [2025 Edition]

Financial planning in 2025 feels more complex, with prices climbing and markets swinging, yet there’s […]

Quick Guide: How To Make a Beginner Meal Plan [2025]

Making a meal plan sits at the sweet spot between saving money and eating well. For beginners, the idea can feel daunting, maybe even impossible, especially with busy routines and tight budgets. But, in my own experience, breaking things down into small steps makes the process easier (and a lot less stressful). Meal planning helps stop the endless cycle of last-minute takeout, surprising you with how much time, money, and mental energy you can actually save.

Organizing Finances: Simple Steps to Take Control of Your Money

Everyone needs a budget and a plan, whether you’re a student or deep into your […]

How to Make a Christmas Budget (And Still Have Fun)

The holidays should feel joyful, not stressful. But let’s be honest—between gifts, decorations, and festive meals, it’s easy to spend more than you should during Christmas. Money worries can suck the fun out of the most wonderful time of the year. That’s why setting a Christmas budget can be the best gift you give yourself. Ramsey Solutions is a trusted name for getting your finances in order. Their EveryDollar tool makes it simple to track spending and avoid post-holiday regret.

Knowing when to Start Looking for Scholarships is Important.

Paying for college is hard, but scholarships help a lot. Many miss how key timing is when searching for them. Starting early can open more chances, ease stress, and give you time to make better applications. Knowing when to start looking for scholarships is important.

How to Break Down Budgeting for Kids [Ramsey Education Basics]

Money plays a big role in our lives, but many adults wish they had learned how to manage it better when they were young. Teaching kids about money isn’t just about giving them a piggy bank. It’s about helping them understand real choices, habits, and what happens as a result. Ramsey Education offers a simple plan made for kids and busy parents. Starting early helps set your child up for a future with less money stress and smarter decisions.

How to Know If a Money Saving Strategy Is Actually Worth It

There is a money saving strategy everywhere you look. Open an app or check your inbox, and you’ll find someone promising the newest way to save. Skip your daily coffee, buy in bulk, make everything yourself—the list goes on. But not every tip is worth it. Sometimes, trying to save actually ends up costing more. And does it make your life harder?

200 Frugal Living Tips for Busy People

Life moves quickly. Most mornings, I’m juggling too many things at once, with coffee going cold and emails piling up. Living simply doesn’t mean skipping fun or watching every penny. For me, it’s about making smart choices that save time, fit my style, and help me save money without adding stress. Saving doesn’t have to feel like losing out. You can spend less and still look good, keep things simple, and stay true to yourself. It’s about picking your spots—a special treat here, a basic shirt there. In these 200 frugal living tips, you’ll find easy advice on shopping, cooking, decorating, fashion, and more. I use this guide every day to live well.

![Payoff Made Simple with this Debt Snowball Tracker [PDFs Included]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-001921.jpg)

![Financial Planning: Smart Ways to Organize Your Money [2025 Edition]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-003032.jpg)

![Quick Guide: How To Make a Beginner Meal Plan [2025]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-28-013321.jpg)

![How to Break Down Budgeting for Kids [Ramsey Education Basics]](https://thefrugalones.com/wp-content/uploads/2025/06/Screenshot-2025-06-15-205512.jpg)