Ready to see your debt shrink, month after month, without feeling overwhelmed? Many people set out to pay off loans with good intentions but lose steam along the way. The secret to crushing debt is as much about psychology as it is about math. That’s where the debt snowball tracker shines. When you combine this approach with a simple visual tracker—like the free printable PDFs linked below—staying on track becomes easier and even a bit more satisfying.

Category: Budgeting

The Frugal Ones share practical budgeting tips, real-life stories, and expert advice to help you save money without feeling deprived or overwhelmed.

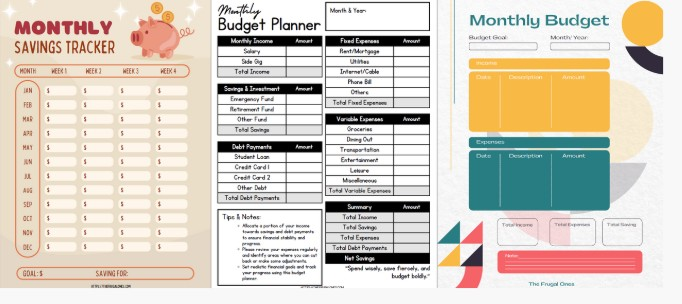

Simple Routines That Make Your Monthly Budget Planner Actually Work

Most people start a monthly budget planner with high hopes. But let’s be honest, it’s easy to fall behind once daily life gets busy. Missed bills, forgotten expenses, and the temptation of a last-minute takeout order can throw off even the most detailed plans. The truth is, the magic isn’t in the planner itself, but in the routines you set up to make it work. Here’s how to build habits that turn your budget into a tool that actually helps you take control of your money—with less stress.

Financial Planning: Smart Ways to Organize Your Money [2025 Edition]

Financial planning in 2025 feels more complex, with prices climbing and markets swinging, yet there’s […]

3-Month Money Challenge: Simple Ways to Reach $5000

Saving $5,000 in three months can feel tough when bills keep coming. You don’t need a big salary or to cut every little expense. This goal is for anyone—parents, young workers, side job earners, or college students—who wants to see real change fast. With a solid plan and a clear list of steps, $5,000 stops being far off and becomes something you can actually reach.

Living Below Your Means: The Secret to Long-Term Wealth

Living below your means might sound simple, but many people get it wrong. They think it means strict rules, missing out, or feeling ashamed for not keeping up with others. That’s not true. The real key to building wealth is having control, lowering stress, and making choices that fit your values.

You don’t need harsh discipline to handle your money well. What matters is how you think about it. Spending less than you earn isn’t a punishment—it’s the base for true freedom.

Best Money Saving Apps of 2025 [Tested and Reviewed]

Tight budgets make saving money feel like a never-ending puzzle. Grocery aisles, endless sale alerts, sneaky subscription fees – it’s easy to feel lost in the chaos. But here’s a secret: the right money saving apps can help you take control of your cash without flipping your whole routine upside down. Gone are the days when tracking every penny meant stashing handwritten receipts in your wallet or wrestling with clunky spreadsheets.

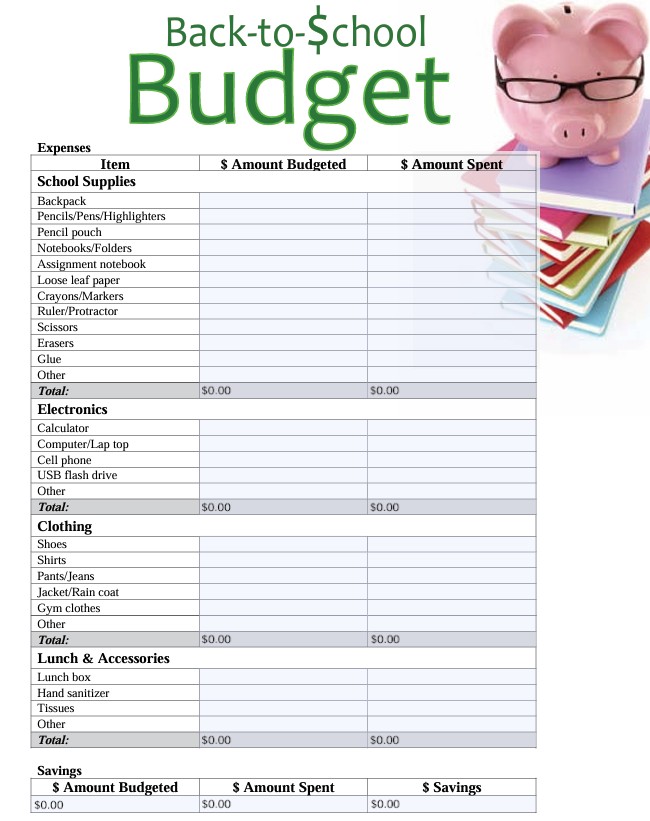

The Truth About School Fees and How to Reduce Them

Every August, stores burst with notebooks, new sneakers, and reminders that back-to-school prep isn’t just about picking out a few fresh pencils. For most families, stocking up on supplies, buying clothes, and enrolling kids in activities is a huge expense. On average, parents spend around $586 per child just on school needs—and that doesn’t even include the $582 many forks over for extracurriculars. Add it up for two or three kids and you’re not buying a new backpack—you’re buying a new bill.

How to Set Financial Goals and Achieve Them

If your financial goals seem out of reach, keep reading to learn some tips and tricks to set goals that stick!

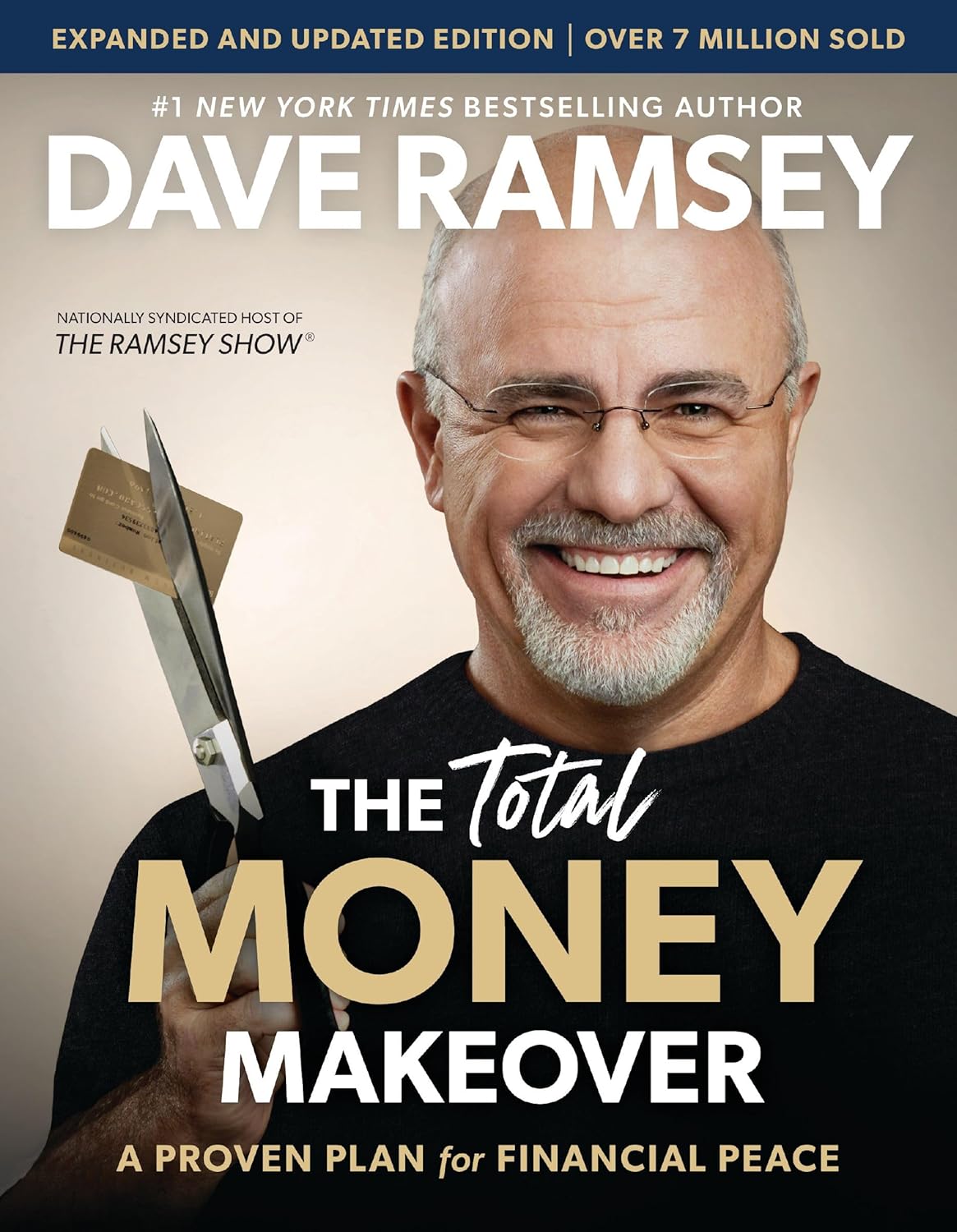

The Best Dave Ramsey Money Hacks for Smarter Budgeting

If you’re curious about smart ways to stretch your money, you’ve probably heard the name Dave Ramsey. He’s built a reputation on straight talk and simple steps anyone can use, whether you’re drowning in debt or just want to build better habits. His advice isn’t full of fluff; it’s direct, practical, and has helped millions regain control of their finances.

The Best Envelope Budgeting Apps for Simpler Money Management

Think back to when people sorted cash into envelopes for each expense. You always knew what you had for groceries or coffee—no surprises. That old trick worked because it was simple and clear. Now, budgeting apps carry that same idea straight to your phone. You can track spending, split budgets with your partner, and see where your money goes, all in one place. No more envelopes or shuffling bills. If you want more control and less stress about money, these apps make it easy. They’re built for all kinds of spenders, whether you love tracking every penny or just want a better handle on your cash.

![Payoff Made Simple with this Debt Snowball Tracker [PDFs Included]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-001921.jpg)

![Financial Planning: Smart Ways to Organize Your Money [2025 Edition]](https://thefrugalones.com/wp-content/uploads/2025/07/Screenshot-2025-07-27-003032.jpg)

![Best Money Saving Apps of 2025 [Tested and Reviewed]](https://thefrugalones.com/wp-content/uploads/2025/06/money-2212965_1280.jpg)