If your financial goals seem out of reach, keep reading to learn some tips and tricks to set goals that stick!

Category: Getting Out of Debt

Discover practical ways to tackle debt with The Frugal Ones. Real stories and expert advice make getting out of debt feel possible and less overwhelming.

How to Stop Living Paycheck to Paycheck [Practical Tips for 2025]

Are You Struggling To Make Ends Meet?

Living paycheck to paycheck. You are not alone! Over one third of the country is living paycheck to paycheck and dipping into debt. Discover 21 frugal hacks that can help you save more money

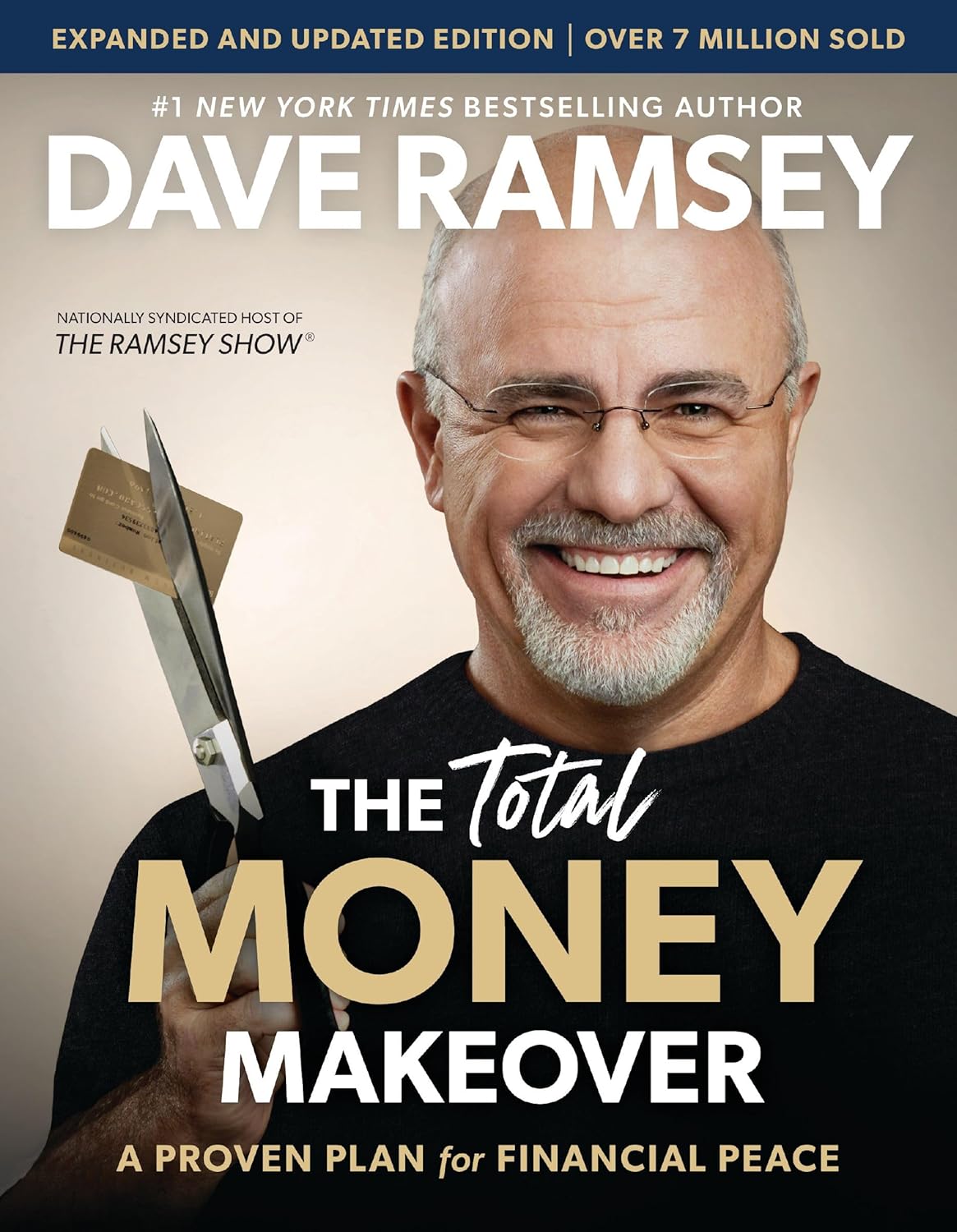

Step-by-Step Frugal Living Using Dave Ramsey’s Baby Steps [Practical Tips]

Saving money doesn’t mean you have to cut out everything you love. It’s more about choosing what matters to you, then letting go of things that aren’t worth it. Frugal living isn’t a punishment; it’s a way to choose your priorities and enjoy what you have. I’ve watched friends stress over every dollar, thinking they had to give up coffee, dinners out, or simple pleasures. But the real shift comes with small, daily choices that add up over time (like learning to cook at home or swapping one streaming service for another). Dave Ramsey’s Baby Steps break this down into clear actions. For many, these steps feel like a real plan instead of another list of financial “rules.” There’s a difference between feeling deprived and feeling in control, and I noticed that when I started following a plan, my stress about money dropped. Living with purpose and having a guide can give you back that sense of freedom and confidence—something that’s easy to forget when you’re just trying to make ends meet.

The Best Dave Ramsey Money Hacks for Smarter Budgeting

If you’re curious about smart ways to stretch your money, you’ve probably heard the name Dave Ramsey. He’s built a reputation on straight talk and simple steps anyone can use, whether you’re drowning in debt or just want to build better habits. His advice isn’t full of fluff; it’s direct, practical, and has helped millions regain control of their finances.

![How to Stop Living Paycheck to Paycheck [Practical Tips for 2025]](https://thefrugalones.com/wp-content/uploads/2025/06/gift-505550_1280.jpg)

![Step-by-Step Frugal Living Using Dave Ramsey’s Baby Steps [Practical Tips]](https://thefrugalones.com/wp-content/uploads/2025/06/accounting-761599_1280.jpg)