Ready to see your debt shrink, month after month, without feeling overwhelmed? Many people set out to pay off loans with good intentions but lose steam along the way. The secret to crushing debt is as much about psychology as it is about math. That’s where the debt snowball tracker shines. When you combine this approach with a simple visual tracker—like the free printable PDFs linked below—staying on track becomes easier and even a bit more satisfying.

Forget juggling random payment plans or guessing your progress. With a clear strategy and a tracker you can hang on the fridge or slip in your planner, you’ll see your wins stack up. Let’s look at why the snowball method just works, how tracking keeps you in the zone, and how to put it all together for a debt-free future.

Understanding the Debt Snowball Tracker Method

The debt snowball tracker method is easy to understand and stick with. You start small and build real momentum as each debt disappears. This isn’t just a numbers game, it’s a series of boosts for your motivation.

How the Debt Snowball Tracker Method Works

Here’s how this method works, step by step:

- List all your debts from smallest balance to largest—ignore the interest rates for now.

- Make the minimum payments on every debt except the smallest.

- Throw every extra dollar you can at the smallest balance until it’s gone.

- When that debt is paid off, take its minimum payment (plus any extra you can manage) and apply it to the next smallest balance.

- Repeat until every debt is wiped out.

What’s the payoff? Each small success builds confidence and keeps you moving forward. Investopedia has a solid overview if you want more info on how the process works.

Debt Snowball vs. Avalanche: Which is Better?

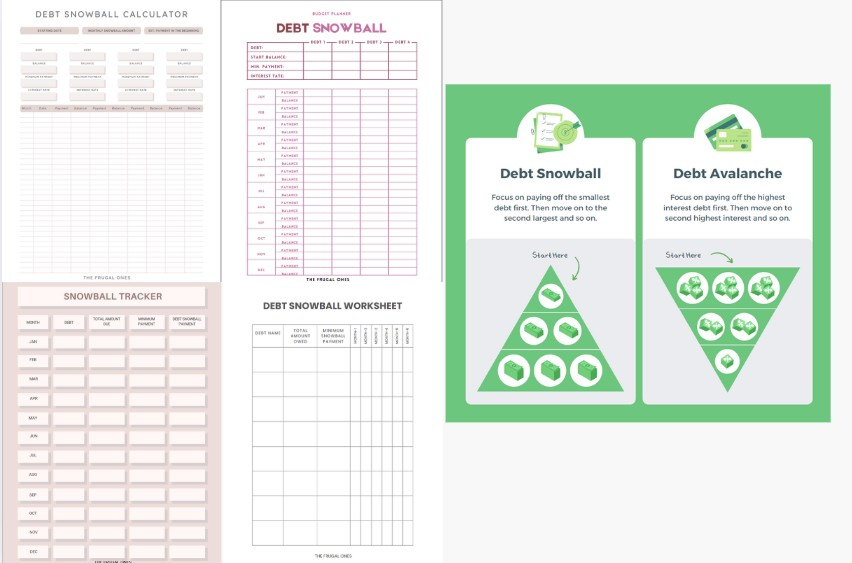

Difference in Debt Snowball vs Debt Avalanche

Some people compare the snowball approach with the avalanche method. The avalanche focuses on highest interest rates first. This is the most efficient way mathematically, but it can feel slow and discouraging. The snowball, by contrast, gives you quick wins and keeps up your drive. Wells Fargo explains both methods and the reasons to pick one over the other.

Why Tracking Your Debt Payoff Accelerates Success

Looking at a spreadsheet now and then isn’t enough. Human brains love progress we can see. Having a tracker turns your journey into a visual story with each payment another step toward the end.

Visual Motivation and Accountability

A tracker isn’t just for fun, it’s science-backed motivation. Seeing those lines colored in or the bar charts edge toward zero triggers a little dopamine hit. That small sense of victory, over and over, creates a feedback loop. You’ll want to stay on track and might even find yourself hunting around the house for extra cash to knock out another chunk of debt.

How to Use the Debt Snowball Tracker PDF Effectively

A printable tracker bridges the gap between goals and daily actions. Here’s how you can start using your free PDF to get organized and crush debt.

Setting Up Your Tracker

- Print the PDF and grab some colored pens or markers.

- List each debt: Write the name, starting balance, minimum payment, and due date for each debt.

- Order them: Start with the smallest balance at the top.

Updating Progress and Staying Consistent

- Each month, record the payment you made and the new balance for each debt.

- Color in or check off milestones when you pay off a loan.

- Plan monthly check-ins to update your tracker.

- Celebrate every finished row.

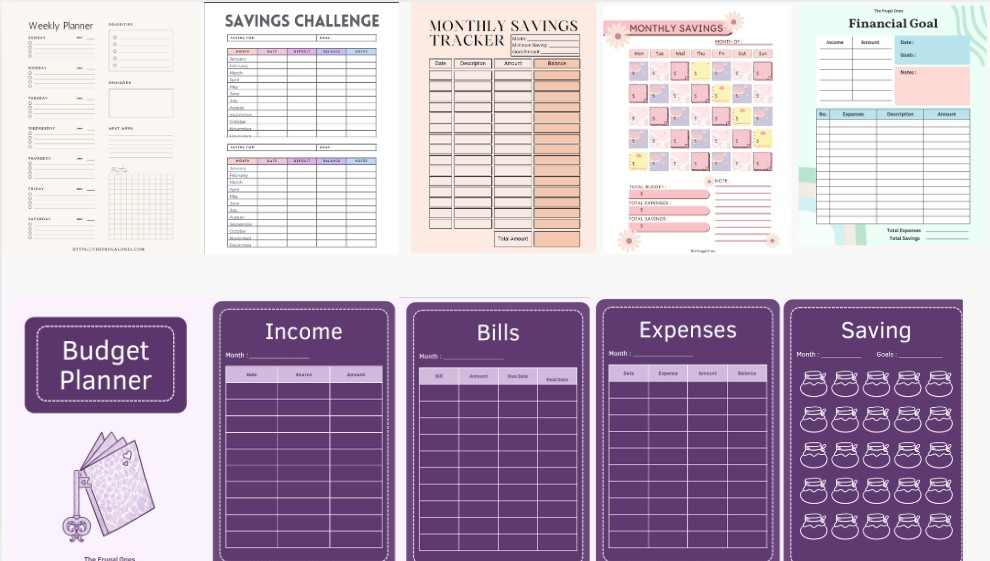

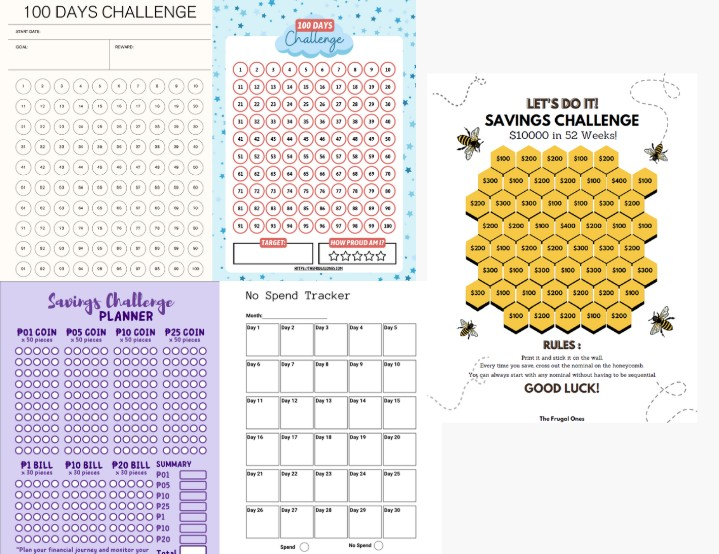

Look for templates you like, from simple checklists to coloring charts. I have included some of my favorite debt snowball trackers for you to download free with no subscription.

Tips for Staying Motivated on Your Debt-Free Journey

Paying off debt is about more than numbers—it’s about resilience, patience, and a sense of achievement. Here’s how to keep up your drive when motivation dips.

- Break your goals down into tiny pieces.

- Share your progress with a trusted friend or partner.

- Remind yourself why you started—write that reason at the top of your tracker.

Celebrating Milestones

Rewards don’t have to break the bank. Try these low-cost ways to celebrate:

- Enjoy your favorite homemade treat.

- Plan a family game night.

- Take a walk in your favorite park or read a new library book.

- Add a sticker or doodle to your tracker each time you hit a target.

Small, intentional celebrations cement the habit and keep you engaged for the long haul.

Download one of the free printable debt payoff trackers for a head start and make the most of each win—your future self will thank you.

Simple Routines That Make Your Monthly Budget Planner Actually Work

Financial Planning: Smart Ways to Organize Your Money [2025 Edition]

Simple Savings Challenges for Busy People with Tight Budgets

Quick Guide: How To Make a Beginner Meal Plan [2025]

Find More Free Time with an Organized Grocery List

Free Savings Tracker Downloads that Make Saving Money Simple

Free Savings Tracker Downloads that Make Saving Money Simple

Download the Best Free Bill Tracker Forms [Updated for 2025]

Subscribe to The Frugal Ones and Get Free Budget Spreadsheets for Smarter Living