Money plays a big role in our lives, but many adults wish they had learned how to break down budgeting for kids when they were young. Teaching kids about money isn’t just about giving them a piggy bank. It’s about helping them understand real choices, habits, and what happens as a result. Ramsey Education offers a simple plan made for kids and busy parents. Starting early helps set your child up for a future with less money stress and smarter decisions.

Building good money habits doesn’t have to feel like extra homework. Ramsey Education provides easy tools and a clear plan that kids can understand—no special knowledge needed. Here’s a look at what works, how these habits grow over time, and tips for different ages, all based on this trusted method.

Core Principles of Ramsey Education for Kids

Dave Ramsey isn’t shy about talking money. His brand is built on straight talk, simple methods, and results you can see. For kids, it comes down to giving, saving, and spending. Each part teaches a different value—generosity, patience, and choice. Youth

The Save, Spend, Give Jars System

Picture this: three empty jars on the kitchen counter. Labeled “Save,” “Spend,” and “Give.” Every dollar a child earns or receives is split among these jars.

- Save: Teaches patience. Whether it’s for a toy or a trip, kids see their money grow.

- Spend: Gives them freedom to make choices, good or bad. Buying candy? Their call.

- Give: Instills generosity. A dollar into “Give” means someone else benefits.

Kids see where their money goes. It isn’t theory; it’s lunch money in action.

Earning Money: Chores vs. Allowance

Ramsey Education draws a clear line: money comes from work, not entitlement. That means pay for chores, not for breathing the same air as everyone else.

- Chores: Washing dishes, taking out trash, folding laundry—small jobs earn small payouts.

- Allowance: Not a handout for existing. Instead, connect outings or treats to work finished.

This simple system teaches kids that money links to effort, not wishes. It may sound old-fashioned, but it works.

The Value of Work and Delayed Gratification

Ever see a kid stare at a toy, trying to decide if it’s worth their hard-earned money? That’s delayed gratification kicking in. Waiting, saving, and thinking twice before spending all build self-control.

Ramsey Education pushes for these lessons early:

- Set goals: Let the child choose what to save for.

- Track progress: Sticker charts, colored jars, whatever keeps it fun.

- Celebrate wins: When they reach their goal, notice. It feels just as good for you as it does for them.

These small steps grow into big skills, preparing kids for car payments, rent, and student loans down the road.

Practical Ways to Teach Kids About Money at Different Ages

What works for a first-grader won’t catch a middle schooler’s attention. Ramsey’s framework adjusts as kids grow, keeping lessons relevant and hands-on.

Money Lessons for Younger Kids (Ages 5–8)

Early elementary kids learn best by doing. Forget spreadsheets—think coins and clear containers.

Simple habits that work:

- Use clear jars, so kids watch savings grow.

- Pay for small chores: setting the table, matching socks.

- Set savings goals for something short-term, like a book or small toy.

- Encourage giving—from a lemonade stand or birthday cash, even a single dollar counts.

Kids at this age learn with their senses. Seeing coins stack up or disappear is much more powerful than numbers on a page.

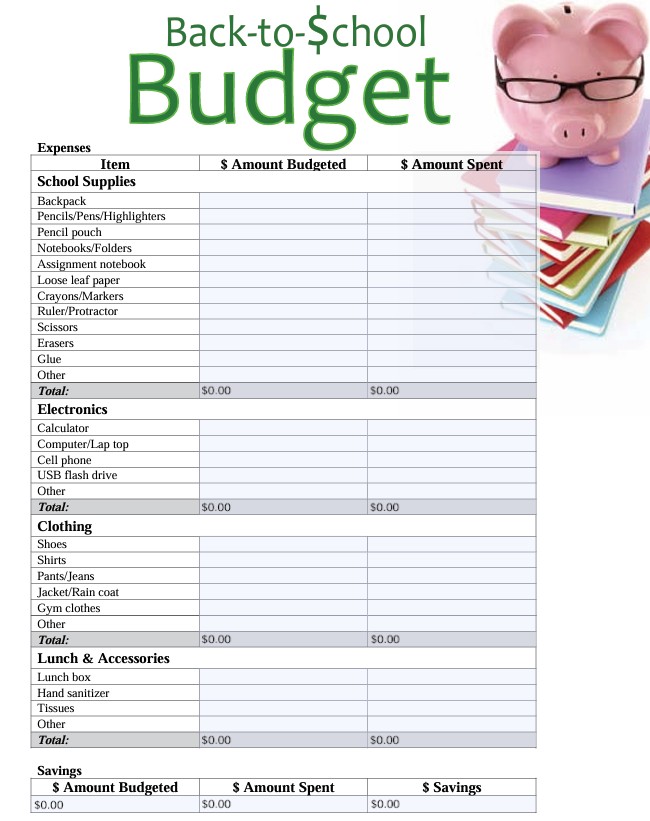

Teaching Preteens (Ages 9–12): Budgeting and Setting Goals

Preteens want more control and independence. Challenge them to plan, not just react.

Practical activities:

- Help them write a simple budget. If birthday money comes in, ask how much to spend, save, give.

- Set long-term goals: maybe a game or a bike that costs more.

- Open a savings account together. Watching interest add up, even slowly, makes saving more appealing.

- Talk about needs vs. wants. List groceries and compare “things to buy now” and “things to save for later.”

Children this age want to know the why behind money rules. Linking chores to rewards sharpens their sense that money is a tool, not a toy.

Engaging Middle Schoolers: Introducing More Advanced Money Concepts

Middle schoolers can tackle bigger ideas. Ramsey Education recommends moving from simple jars to banks and real budgets.

Engage them with:

- More complex chores with higher pay: babysitting, yard work, help with family projects.

- Real-life budgeting: give them part of the family’s grocery cash and help them plan meals.

- Open their first real (joint) bank account. Show them how to track spending.

- Explain interest, debt, and credit cards. Use simple stories or personal examples.

- Encourage short-term and long-term savings. A trip, a tablet, or even a charity project.

This age wants independence but still needs guidance. Honest talks and open books show what adult choices look like, without too much pressure.

Financial Lessons are Best Learned Early

Learning about money is easier when kids start young. Mistakes are smaller, and good habits can grow. Ramsey Education offers a simple plan: earn money, then divide it for spending, saving, and giving. Decisions should match what matters most to you.

The payoff lasts a lifetime. Kids learn to wait, plan ahead, and share with others. They understand that hard work earns rewards and that patience and kindness bring benefits. Parents and teachers can use Ramsey’s ideas anytime, adjusting for each child’s age.

Consistency matters more than getting it right every time. Starting late is okay. Learning with your child helps even more. The goal is a young adult who feels confident and clear about money.

There are many free and paid options—Ramsey Solutions’ website, library programs, and local groups often have classes or workshops. Give your child a gift that lasts: the skill to handle money wisely for life.