Saving money on a tight budget feels a bit like juggling while running late. Time is short, cash is tight, and most days, the idea of putting something aside seems out of reach. But here’s the thing: you don’t need a complicated spreadsheet or a big income to start growing your savings. By using a few simple savings challenges, those tiny changes can turn into real progress, all without giving up your morning coffee or staying up late budgeting.

Why Simple Savings Challenges Work for Busy People

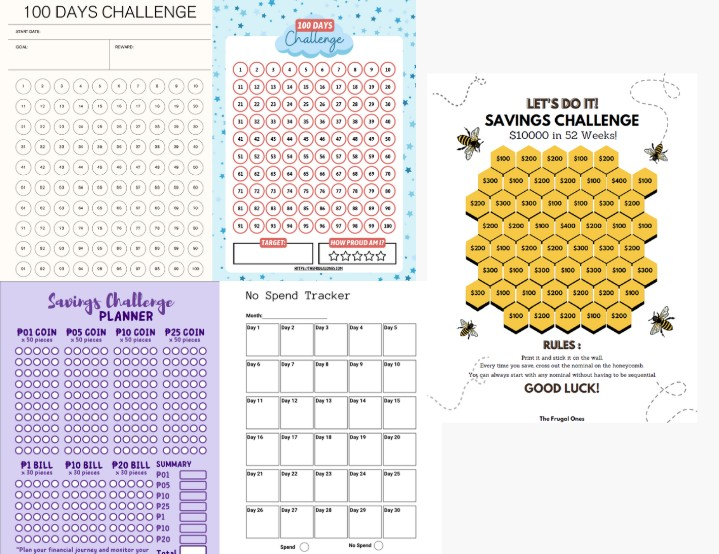

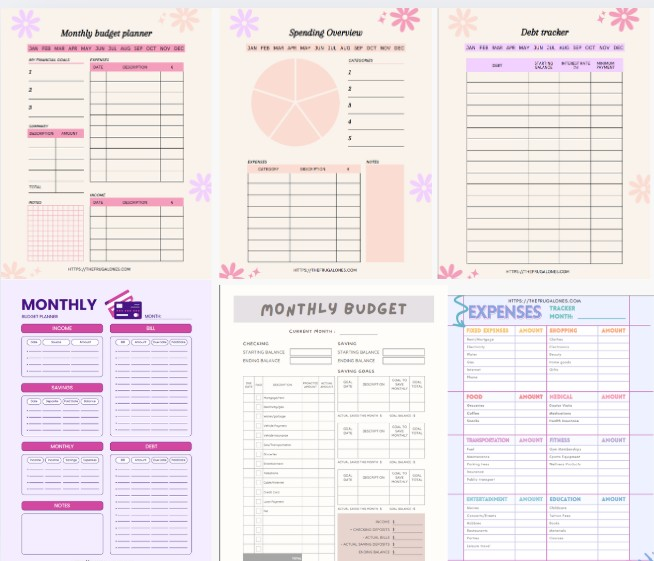

Simple savings challenges strip out the mental gymnastics. Instead of analyzing every purchase or tracking endless categories, challenges make things concrete and visual. There’s a psychological boost: achieving small wins keeps motivation high, even on busy days when you can’t focus on the big picture. Setting specific goals also adds a layer of accountability, which is especially helpful for those balancing work, family, and endless to-do lists.

According to The Frugal Ones, small challenges are enticing exactly because they fit into a hectic schedule and limited budget. The fun (sometimes even random) rules of savings challenges can turn the process into a bit of a personal game.

Top Simple Savings Challenges to Try

The beauty of these challenges is simplicity—they work behind the scenes in the middle of real life. No overthinking needed.

The $1 or $5 Bill Simple Savings Challenges

Each time you get a $1 or $5 bill, stash it away in a jar, envelope, or hidden spot in your wallet. Ignore it until a set date, then count your savings. This method is low-effort and surprisingly effective. Sometimes, what begins as pocket change ends up covering a birthday gift, an emergency, or even a weekend treat. To stay consistent:

- Designate a place (physical or digital) to save your bills.

- Set a reminder on your phone to move cash each week, so you don’t forget.

- Celebrate milestones, even if it’s just a few dollars at a time.

The 52-Week Challenge (Simplified Version)

The original challenge asks you to save increasing amounts each week, but for tight budgets, that can feel overwhelming by week 30 or 40. Instead:

- Pick a fixed, small amount ($1, $3, or $5 per week).

- Use a tracking app or printable chart to check off weeks as you go.

- Treat it as flexible—if you miss a week, no guilt, just pick up where you left off.

No-Spend Day or Week Challenge

Pick one day, week or month when you don’t spend any money (except for essentials like bills or emergencies). It’s like giving your wallet a reset button. For busy people, this often fits best on days crammed with activities or at-home family nights—you’re too busy to shop anyway.

Quick tips:

- Plan meals ahead.

- Avoid browsing online stores out of habit.

- Keep a note of cravings or “almost bought” items to review later (you may realize you didn’t really want them).

Spare Change or Round-Up Challenge

If you pay cash, collect your coins in a jar and watch the pile grow. Prefer cards? Many banks and apps let you round up each purchase to the nearest dollar, moving the difference to savings automatically. It’s nearly invisible and requires no effort after the first setup. This trick can save dozens of dollars a month without thinking twice.

Tips for Sticking with Your Savings Challenge

The hardest part is keeping momentum, especially when life gets hectic. Routines fade, but a few tricks help you stay on track:

- Visual progress: Tape a chart on the fridge or use an app to watch your savings grow.

- Set reminders: Weekly phone alerts make it impossible to forget.

- Find a buddy: Doing it with a friend or family member adds accountability.

- Small rewards: Give yourself credit for reaching your mini-goals along the way.

Practical advice on forming habits and making money-saving automatic is available from Ramsey Solutions, if you need some extra motivation.

What to Do with Your Savings

So you completed a challenge and have a little pile of savings. What now? Start with the basics:

- Grow an emergency fund (even $250 can cushion unexpected expenses).

- Pay off a small bill or debt.

- Treat yourself to something meaningful, guilt-free.

- Put it toward a future goal like travel, classes, or home upgrades.

Prioritize your biggest stressor or most exciting dream—let the results feel real.

Quick Guide: How To Make a Beginner Meal Plan [2025]

Find More Free Time with an Organized Grocery List

Free Savings Tracker Downloads that Make Saving Money Simple

Free Savings Tracker Download that Makes Saving Money Simple

Download the Best Free Bill Tracker Forms [Updated for 2025]

Subscribe to The Frugal Ones and Get Free Budget Spreadsheets for Smarter Living